12 Best Credit Cards for International Students in 2025

Welcome to the U.S.! One of your first and most important financial steps is building a credit history. A strong credit score is essential for renting an apartment, getting a phone plan without a hefty deposit, and securing future loans. However, navigating the U.S. credit card market without a Social Security Number (SSN) can be a significant challenge for many newcomers.

Fortunately, many international students can use an Individual Taxpayer Identification Number (ITIN) to apply for credit. This guide is designed to simplify that process. We’ve compiled a definitive list of the best credit cards for international students, focusing specifically on options that accept ITINs, feature low or no foreign transaction fees, and offer rewards that align with a student lifestyle.

We'll move beyond generic marketing points to provide an in-depth analysis of each card's real-world benefits, specific eligibility requirements, and potential drawbacks. Consider this your roadmap to making an informed decision. Our goal is to help you confidently choose the right card to begin building your U.S. financial foundation. Each option in our list includes screenshots and direct links to help you navigate the application process smoothly.

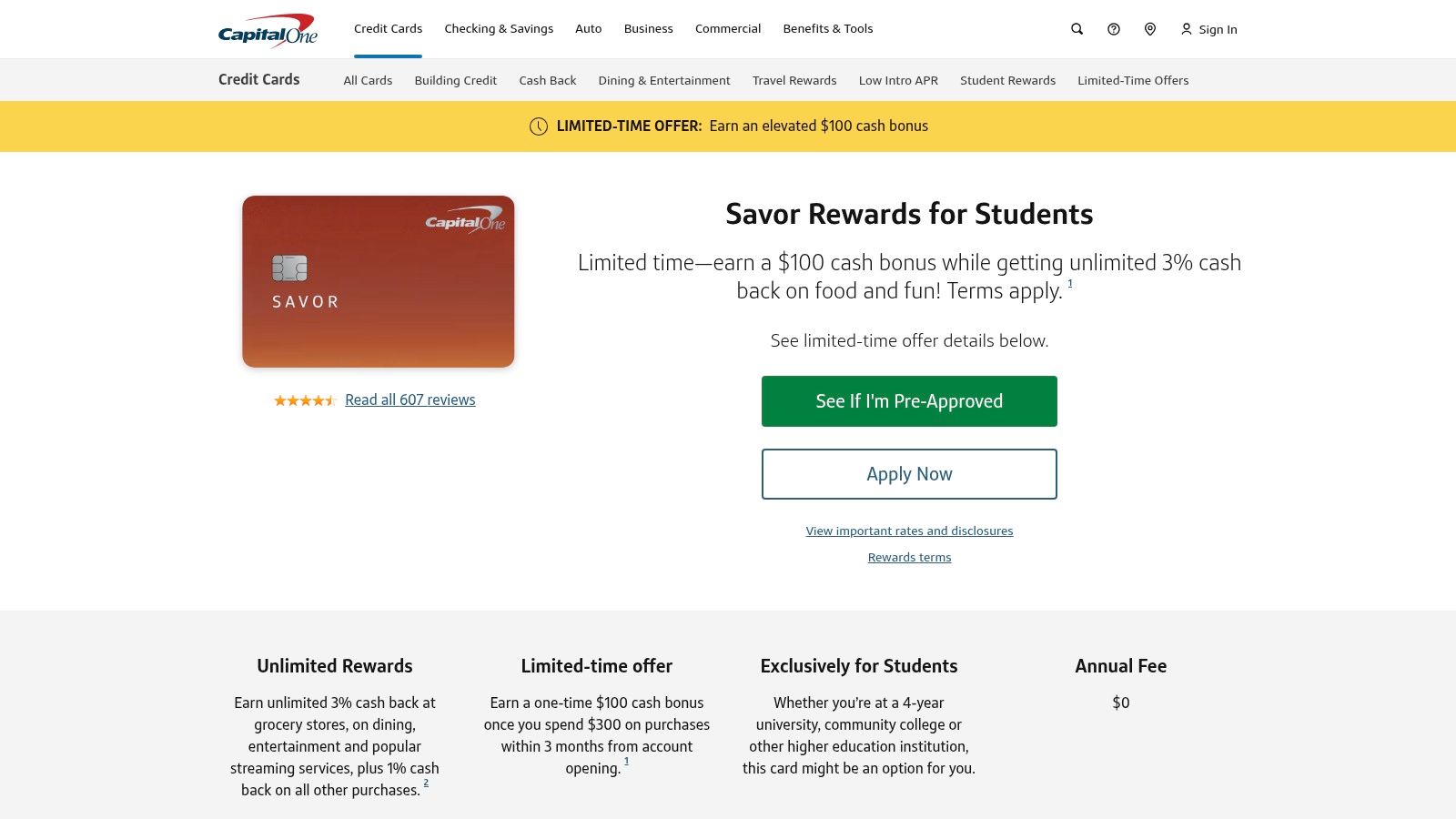

1. Capital One SavorOne Student

The Capital One SavorOne Student card is an excellent starting point for international students looking to build credit while earning practical rewards. Its primary strength lies in its high cash back rates on categories that align perfectly with a student lifestyle: dining, entertainment, popular streaming services, and groceries. This card is one of the best credit cards for international students because it eliminates foreign transaction fees, a crucial feature for anyone traveling home or making purchases from international vendors.

What truly sets it apart is the combination of a $0 annual fee with such strong reward categories, which is rare for student cards. The application process is also friendly to those new to the U.S. financial system. Capital One often allows applicants to use an ITIN instead of an SSN, and their pre-approval tool lets you check your eligibility without a hard inquiry on your credit report.

Key Features & Considerations

Website: https://www.capitalone.com/credit-cards/savorone-student/

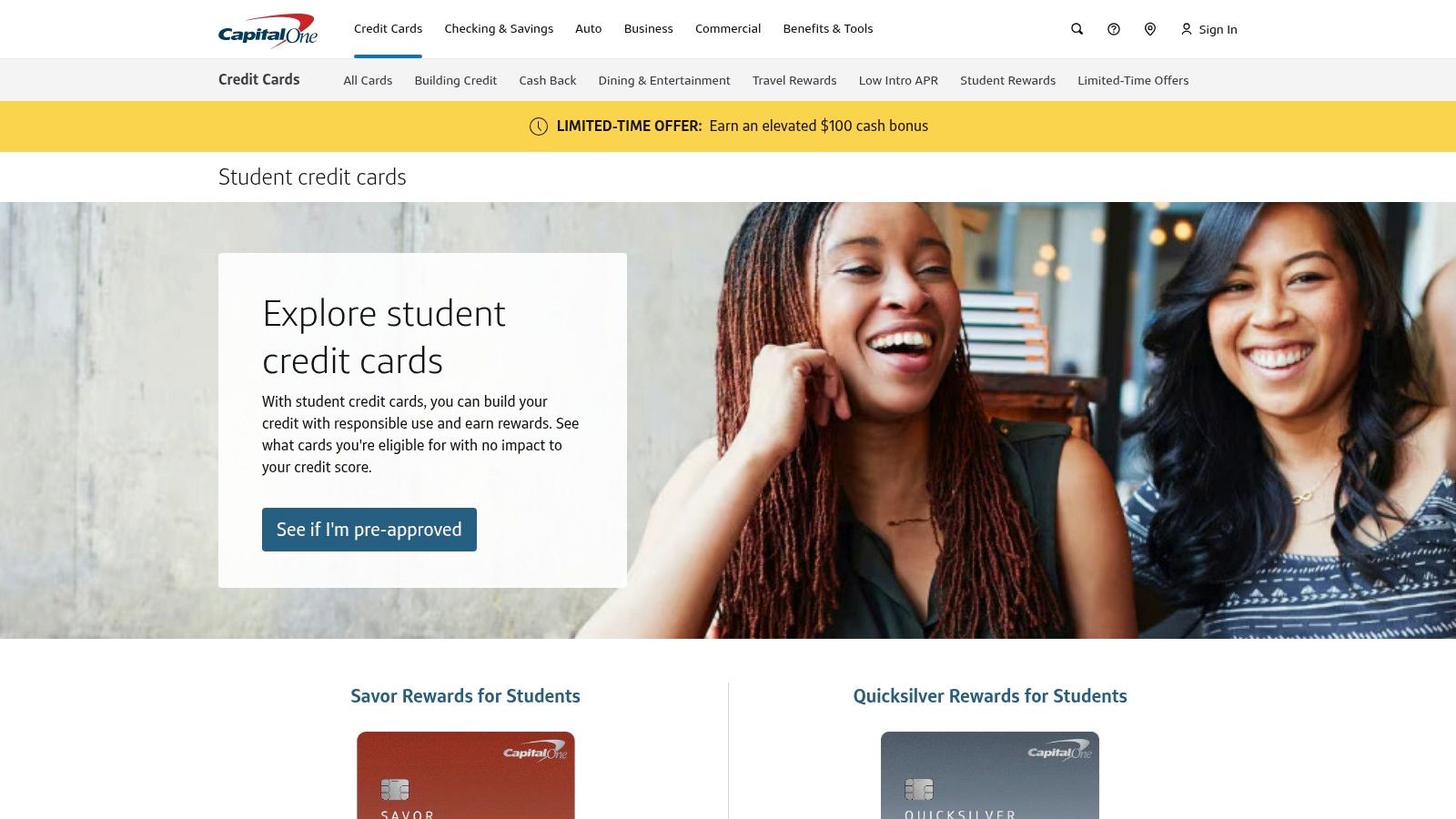

2. Capital One Quicksilver Student

The Capital One Quicksilver Student card offers a refreshingly simple approach to rewards, making it a top contender for international students who prefer predictability. Instead of tracking bonus categories, this card provides a straightforward, flat 1.5% cash back on every single purchase. This simplicity, combined with its crucial lack of foreign transaction fees, makes it one of the best credit cards for international students who travel or make purchases from their home country.

Its key advantage is the blend of a $0 annual fee and an uncomplicated rewards structure, ideal for someone new to the complexities of U.S. credit. Like other Capital One student offerings, it is accessible to applicants with an ITIN instead of an SSN. You can also check your eligibility with their pre-approval tool, which won't impact your credit score, providing a low-risk way to see if you qualify.

Key Features & Considerations

Website: https://www.capitalone.com/credit-cards/students/

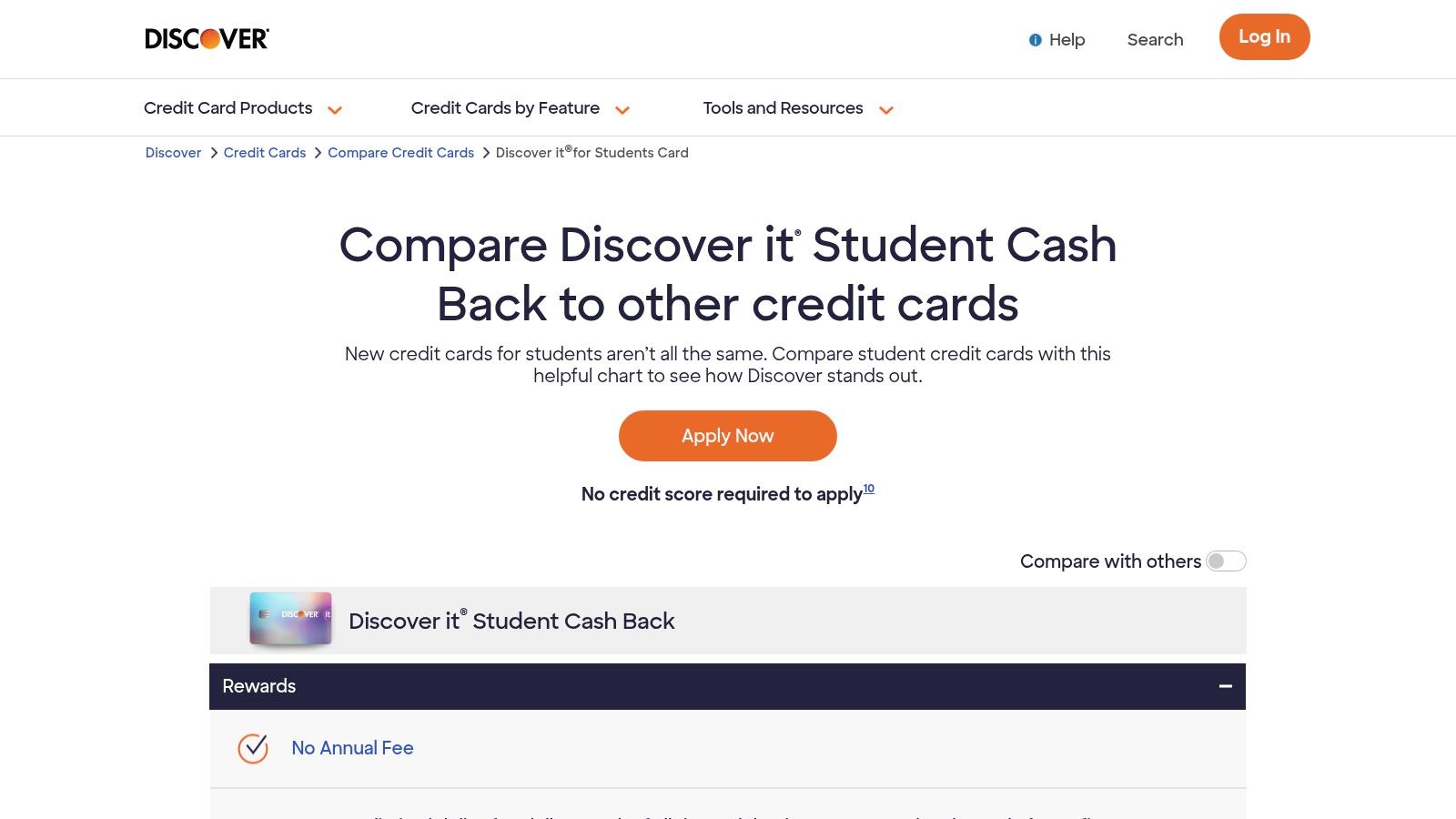

3. Discover Student Cards

The Discover student card lineup, including the popular Discover it Student Cash Back and Student Chrome, offers a compelling package for international students. These cards are designed for those with no credit history, making them an accessible entry point into the U.S. credit system. A key benefit is that Discover waives foreign transaction fees, which is a critical feature for students who may travel home or purchase items from their home country.

What makes Discover exceptional for new cardholders is its unique Cashback Match program. At the end of your first year, Discover will automatically match all the cash back you've earned, effectively doubling your rewards. This incredible first-year value, combined with a $0 annual fee and the potential to apply with an ITIN, solidifies Discover's place as one of the best credit card issuers for international students.

Key Features & Considerations

Website: https://www.discover.com/credit-cards/compare/student-cash-back.html

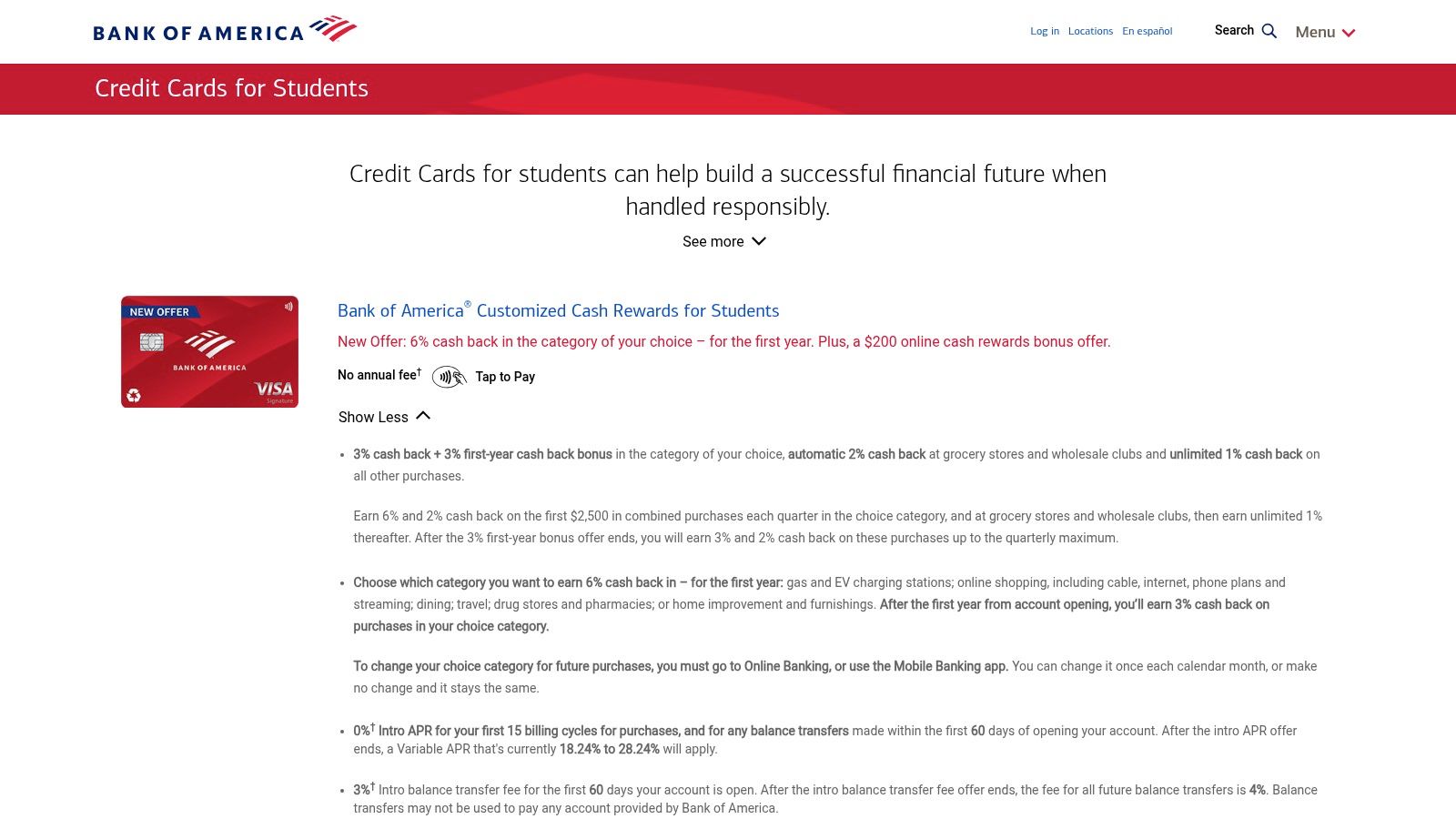

4. Bank of America — Student Credit Cards

Bank of America provides a centralized platform for student credit cards, offering international students the chance to build a relationship with one of the largest U.S. banks. The key advantage here is the choice between different reward structures, such as cash back or travel points, all under one roof. This flexibility makes it one of the best credit cards for international students, as you can select a card that aligns with your specific spending habits, whether that’s earning on everyday purchases or saving for trips back home.

What makes Bank of America stand out is the potential for a deeper banking relationship. Holding a credit card and a student checking account can unlock benefits through their Preferred Rewards program later on. While their underwriting can be stricter than some fintech options, establishing a history with a major bank early on is a significant long-term benefit. Their student cards also feature a $0 annual fee, making them an accessible entry point.

Key Features & Considerations

Website: https://www.bankofamerica.com/credit-cards/student-credit-cards.go

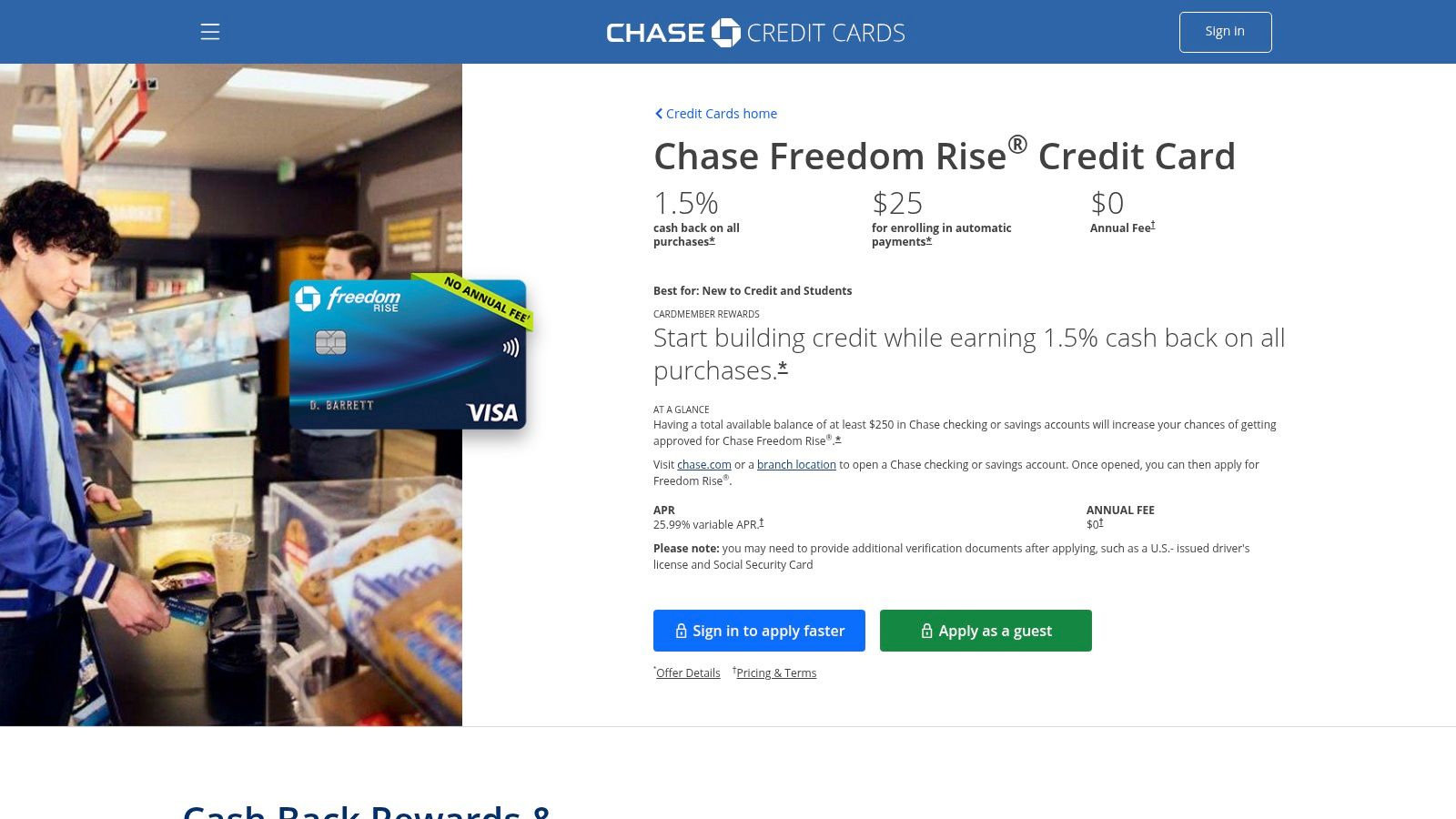

5. Chase Freedom Rise

The Chase Freedom Rise card is a strong contender for international students who are building a banking relationship with a major U.S. institution. It offers a straightforward, flat-rate cash back program, making it easy to earn rewards on all purchases without tracking categories. This card is one of the best credit cards for international students because it provides a clear pathway into the highly-regarded Chase Ultimate Rewards ecosystem, allowing for future upgrades to more premium cards.

What makes the Freedom Rise stand out is its approval process, which is designed for those new to credit. Chase states that having a Chase checking account with a balance of at least 250 can increase your approval odds, offering a tangible step for applicants to take. This, combined with a **0 annual fee** and a simple rewards structure, makes it an accessible and valuable tool for establishing U.S. credit history.

Key Features & Considerations

Website: https://creditcards.chase.com/cash-back-credit-cards/freedom/rise/

6. American Express — U.S. Newcomers

American Express, through its U.S. Newcomers program, offers a unique pathway for international students with established credit in their home country. Instead of starting from scratch, this platform allows applicants to leverage their foreign credit history through an integration with Nova Credit. This makes it one of the best credit cards for international students who want to skip the secured card phase and qualify for premium rewards cards sooner. The program provides access to the full suite of renowned AmEx cards and their powerful rewards ecosystem.

What truly sets this option apart is its ability to translate international credit data into a U.S.-equivalent report, potentially unlocking cards that are typically out of reach for newcomers. While an SSN or ITIN and a U.S. address are still required, this initiative removes the significant barrier of having no U.S. credit file. The platform also provides valuable educational resources to help newcomers understand and build their financial footprint in the United States.

Key Features & Considerations

Website: https://www.americanexpress.com/us/credit-cards/features-benefits/us-newcomers/how-to-establish-and-build-us-credit.html

7. Nova Credit

Nova Credit isn't a credit card issuer but a crucial platform that serves as a bridge for newcomers to the U.S. financial system. It allows international students to use their credit history from their home country to apply for certain U.S. credit cards. This is a game-changer because it addresses the primary obstacle many students face: having no U.S. credit file. The platform partners with major issuers like American Express, providing a guided application process where your international data is translated into a U.S.-equivalent report.

What makes Nova Credit one of the best resources for international students is its unique Credit Passport® technology. The service is free for applicants and streamlines what would otherwise be an impossible application. Instead of starting from scratch, you can leverage your established financial responsibility from abroad. This gives you a better chance of approval for premium cards that would typically require an existing U.S. credit history.

Key Features & Considerations

Website: https://www.novacredit.com/resources/how-to-apply-for-an-american-express-card-with-your-international-credit-history

8. Petal Card

Petal Card offers a modern approach to credit, making it an excellent choice for international students who are just starting their financial journey in the U.S. Instead of relying solely on traditional credit scores, Petal uses an innovative "Cash Score" derived from your banking history to assess creditworthiness. This cash-flow underwriting model provides a vital pathway for students with thin or no credit files, a common hurdle for newcomers. The card is designed to be accessible and is one of the best credit cards for international students thanks to its acceptance of ITINs and its lack of foreign transaction fees.

What makes Petal stand out is its commitment to financial education and transparency through its mobile app, which offers tools to help you understand and manage your spending. By linking your U.S. bank account, you can demonstrate responsible financial behavior, even without a prior credit history. This unique approval process, combined with a $0 annual fee and the global acceptance of the Visa network, makes it a powerful and practical tool for building credit.

Key Features & Considerations

Website: https://www.petalcard.com/

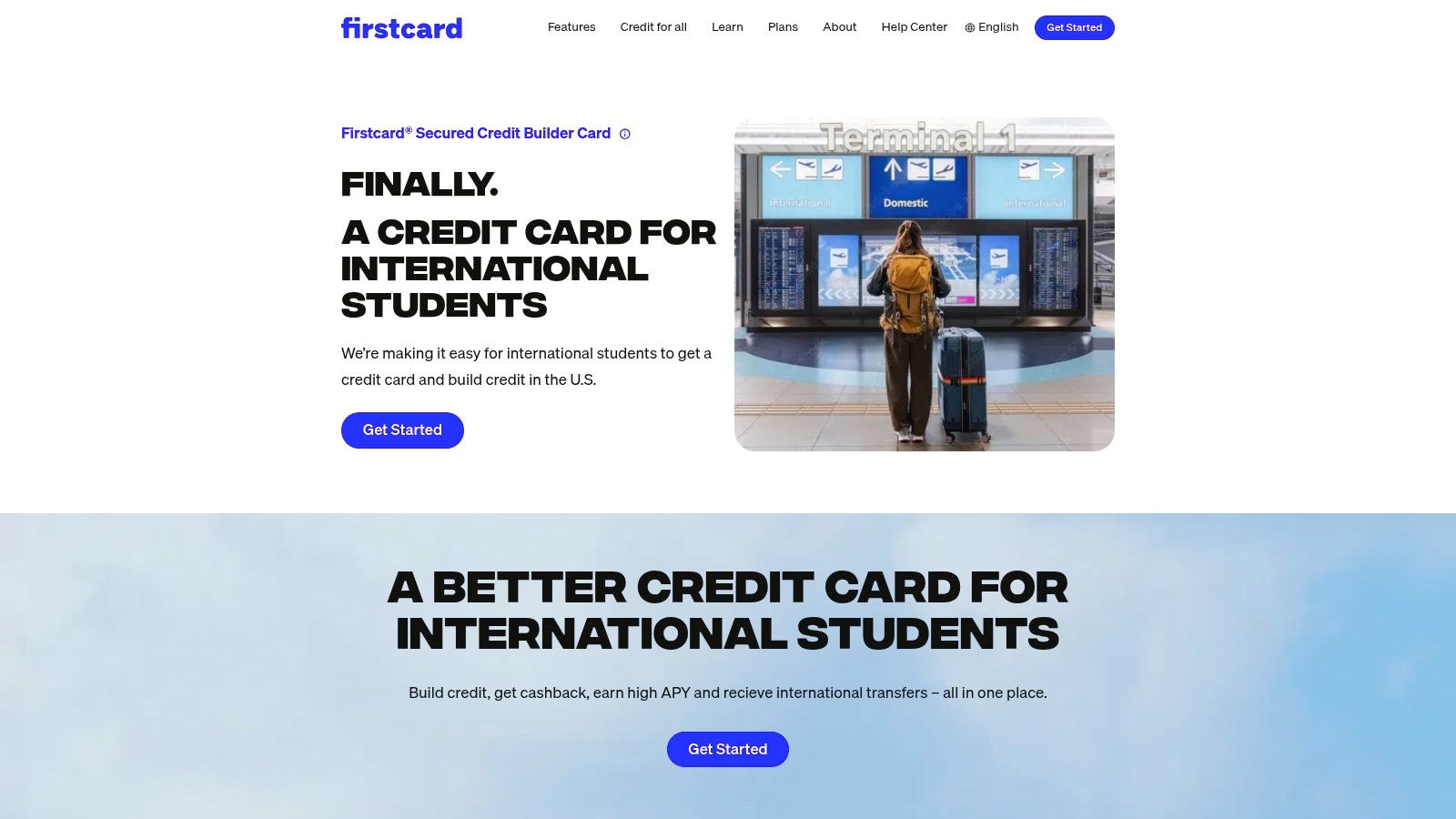

9. Firstcard

Firstcard is a fintech platform built from the ground up to address the unique financial challenges faced by international students. This secured Mastercard is designed to be one of the most accessible credit-building tools, allowing applicants to use a passport or visa for identity verification, completely bypassing the need for an SSN or ITIN during the initial application. This makes it a standout option for students who have just arrived in the U.S. and haven't established any financial footprint yet.

What makes Firstcard one of the best credit cards for international students is its sole focus on this demographic. The entire experience, from application to credit reporting, is tailored to newcomers. The card requires a security deposit that sets your credit limit, and your FDIC-insured funds are held securely. By reporting your payment history to all three major credit bureaus (Experian, Equifax, and TransUnion), it provides a powerful and direct path to building a strong credit score.

Key Features & Considerations

Website: https://www.firstcard.app/credit-card/international-student-credit-card

10. NerdWallet — Best College Student Credit Cards

Rather than a single card, NerdWallet is a powerful comparison website that acts as a comprehensive starting point for your research. It provides independent, up-to-date rankings and detailed reviews of the best student credit cards, many of which are accessible to international students. This platform is an invaluable resource because it consolidates information, allowing you to compare features like rewards, fees, and issuer requirements side-by-side, saving you the effort of visiting dozens of bank websites individually.

What makes NerdWallet particularly useful is its filtering tool and clear, editorial-style reviews that break down complex terms. It often highlights which cards are friendly to applicants without an SSN and provides direct links to the card issuers. This helps you narrow down your choices and understand the nuances of each option before you apply, which is crucial for anyone trying to establish credit history for the first time in the U.S.

Key Features & Considerations

Website: https://www.nerdwallet.com/best/credit-cards/college-student