8 Key Benefits of Balance Transfer in 2025 You Need to Know

Unlocking Financial Freedom: The Strategic Power of Balance Transfers

High-interest credit card debt can feel like an anchor, holding you back from your financial goals. For many, including ITIN holders, freelancers, and recent immigrants building a financial life in the U.S., managing multiple high-APR balances is a significant obstacle. A balance transfer offers a powerful and strategic solution to this common problem. By moving outstanding balances from high-interest cards to a new card with a low or 0% introductory annual percentage rate (APR), you can fundamentally change your approach to debt repayment. This isn't just about shuffling debt around; it's a calculated move to save money, simplify your finances, and accelerate your journey toward becoming debt-free.

The benefits of a balance transfer extend far beyond simple interest savings. Executed correctly, this financial tool can help consolidate multiple payments into one, improve your credit utilization ratio, and provide crucial breathing room to get your finances back on track. This article will provide a detailed breakdown of the key advantages you can gain. We will explore eight specific benefits, complete with actionable steps and practical examples tailored for individuals who may be navigating the U.S. financial system with an ITIN or as a self-employed professional. Get ready to learn how to leverage a balance transfer as a strategic step toward financial control and stability.

1. Lower Interest Rates

The most significant and immediate of the benefits of balance transfer is the potential to drastically reduce your interest rate. This strategy involves moving outstanding debt from a credit card with a high annual percentage rate (APR) to a new card offering a much lower rate, often a promotional 0% APR for an extended period. By doing this, you can pause the relentless cycle of high-interest charges, allowing more of your payment to go directly toward reducing the principal balance.

For individuals building their financial lives in the U.S., such as those with an ITIN, managing high-interest debt is a critical step toward financial stability. A balance transfer provides a powerful tool to take control of this debt.

How It Translates to Real Savings

The financial impact can be substantial. Imagine you have a 5,000 balance on a card with a 24.99% APR. If you only make minimum payments, a significant portion of your money is consumed by interest. Moving that 5,000 to a card with a 0% introductory APR for 18 months means that for a year and a half, every dollar you pay goes toward erasing the debt itself, not just feeding the interest. This single move could save you over a thousand dollars in interest payments.

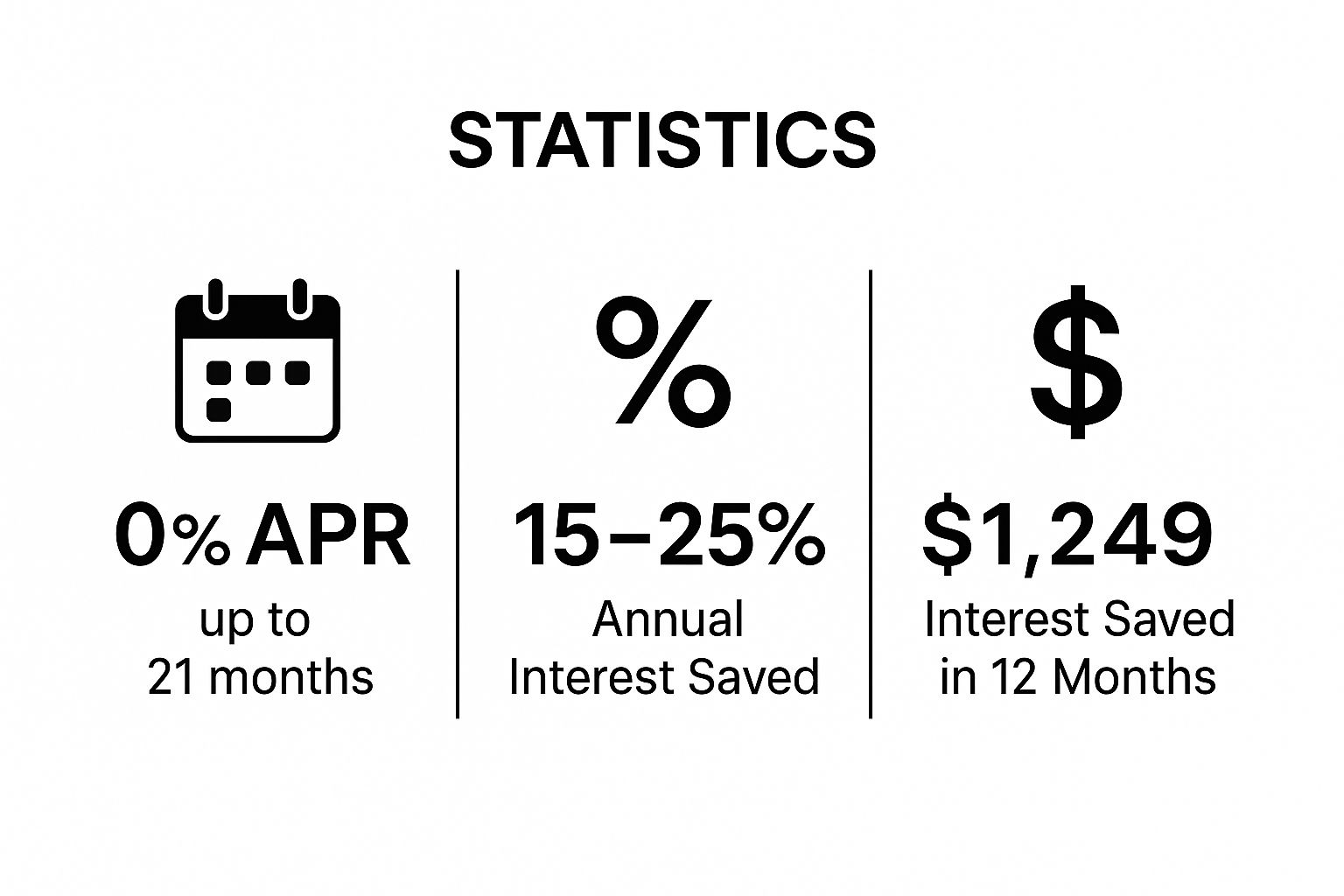

This infographic highlights the potential savings and key features associated with a strategic balance transfer.

These figures illustrate how a 0% APR period of up to 21 months can directly translate into significant financial savings, stopping high interest charges in their tracks.

Actionable Tips for Success

To make the most of this benefit, consider these practical steps:

2. Debt Consolidation

Another one of the key benefits of a balance transfer is its power to simplify your financial life through debt consolidation. This strategy allows you to combine multiple high-interest credit card balances from different issuers into a single, new credit card account. By consolidating, you streamline your payments, reduce the mental load of tracking several due dates and interest rates, and create a much clearer, more manageable path toward becoming debt-free.

For those new to the U.S. financial system, including ITIN holders, managing multiple bills can be overwhelming. A balance transfer consolidates these into one monthly payment, making it easier to stay organized and avoid late fees.

How It Translates to Real Savings

The primary advantage here is simplicity and focus, which directly translates into better financial outcomes. Imagine juggling three separate credit cards: one with a 2,000 balance, another with 3,500, and a third with $1,800. Managing these different due dates, minimum payments, and high APRs can lead to missed payments and added stress.

By transferring all three balances, totaling $7,300, to one new card, you now have a single bill to focus on. Many cards are designed for this; for example, some issuers allow you to transfer balances from multiple creditors in one application. This consolidation simplifies your budget and empowers you to channel all your debt-repayment energy into one account, often with a 0% introductory APR.

Actionable Tips for Success

To make the most of debt consolidation via a balance transfer, follow these steps:

3. Improved Cash Flow

Another one of the key benefits of a balance transfer is the immediate improvement to your monthly cash flow. By transferring high-interest debt to a 0% APR card, you eliminate or drastically cut the portion of your payment that goes toward interest. This frees up a significant amount of money in your monthly budget, providing you with greater financial flexibility.

For ITIN holders building a financial foundation in the U.S., this freed-up cash can be a game-changer. It provides the breathing room needed to cover essential expenses, build an emergency fund, or pursue other financial goals without the constant pressure of expensive debt. This strategic move can also help you manage your credit utilization more effectively. You can learn more about managing credit utilization on itinscore.com to further enhance your financial health.

How It Translates to Real Savings

The impact on your budget can be felt right away. Consider a 5,000 credit card balance with a 22% APR. Just paying the interest would cost you over 90 per month. If you wanted to pay it off in one year, your monthly payment would need to be around 468. After a balance transfer to a 0% APR card, a payment of just 278 per month would clear the debt in 18 months. This effectively adds nearly $190 back into your monthly budget during the promotional period.

This extra cash isn't just a number; it's a tangible resource you can redirect. You could use it to start an emergency fund, make extra contributions to a retirement account, or simply have a buffer for unexpected costs.

Actionable Tips for Success

To leverage this improved cash flow effectively, follow these steps:

4. Extended Repayment Timeline

Another of the key benefits of balance transfer is gaining an extended, interest-free period to pay down your debt. Many balance transfer cards offer promotional 0% APR periods lasting from 12 up to 21 months. This creates valuable breathing room, allowing you to make steady progress on your principal balance without the pressure of high interest charges constantly adding to it.

For those navigating the U.S. financial system, perhaps as an ITIN holder, this extended timeline provides a crucial opportunity. It allows for more predictable and manageable monthly payments, making it easier to budget and plan your finances while actively reducing debt. This structured approach is fundamental to building a stable financial future.

How It Translates to Real Savings

An extended repayment window makes debt elimination feel far more achievable. Consider a 5,000 balance. If you wanted to pay it off in just 10 months to avoid interest on a standard card, you would need to pay 500 per month. However, moving that balance to a card with a 21-month 0% APR promotional period, like the Wells Fargo Reflect Card, drops your required monthly payment to approximately 238 to become debt-free before the promotion ends. This frees up over 260 in your monthly budget.

This flexibility allows you to tackle debt without sacrificing your ability to manage other essential expenses, a critical advantage for anyone working to establish financial security.

Actionable Tips for Success

To effectively use the extra time and maximize your savings, implement these strategies:

5. Credit Score Improvement Potential

Beyond immediate financial relief, another one of the key benefits of balance transfer is its potential to positively impact your credit score. This happens primarily by lowering your credit utilization ratio, which is the amount of credit you're using compared to your total available credit. By moving a large balance to a new card, you instantly reduce the utilization on the original card and may lower your overall utilization, signaling responsible debt management to credit bureaus.

For those building a U.S. credit history, especially ITIN holders, demonstrating this kind of strategic financial management can be a powerful step toward a stronger credit profile.

How It Translates to a Better Score

The effect on your score can be significant and relatively quick. For instance, if you have a single credit card with a 5,000 limit and an outstanding balance of 4,500, your utilization is a very high 90%. By transferring that balance to a new card with a 10,000 limit, your overall utilization drops to 30% (4,500 debt across $15,000 total credit). This single change can lead to a notable score increase, as utilization accounts for a large portion of your credit score.

This infographic details the various factors that influence your credit score and how strategic actions like a balance transfer can make a difference. These figures underscore how managing credit utilization is a direct path to improving your financial standing.

Actionable Tips for Success

To leverage a balance transfer for credit score improvement, follow these specific strategies:

6. Breathing Room for Financial Recovery

One of the most overlooked benefits of balance transfer is the mental and financial "breathing room" it creates. By halting the relentless accrual of high interest, you get a crucial pause. This allows you to shift your focus from simply treading water against mounting debt to addressing the root causes of your financial stress and building a more resilient foundation.

This relief is especially valuable for those navigating the U.S. financial system, such as ITIN holders, who can use this period to establish stability. A balance transfer provides the time needed to develop sustainable financial habits without the constant pressure of escalating debt.

How It Translates to Real Progress

The impact of this breathing room extends beyond simple debt repayment. Imagine you secure a card with a 0% APR for 18 months. This period isn't just for paying down your balance; it's an opportunity to build an emergency fund. You could dedicate a portion of your monthly income to savings, accumulating a 2,000 or 3,000 cushion while simultaneously making steady, interest-free payments on your debt.

This time also allows you to address income instability or seek financial education. You can pursue financial counseling or take a budgeting course to develop stronger skills, ensuring you don't fall back into debt once the promotional period ends. The goal is to use this temporary reprieve to create lasting financial change.

Actionable Tips for Success

To make the most of this financial space, implement these strategies:

7. Strategic Debt Management

Beyond simply moving a single balance, one of the more advanced benefits of balance transfer is its role in sophisticated debt management. This strategy allows you to gain control over your entire debt portfolio, not just one account. You can purposefully restructure your debts, prioritize which ones to eliminate first, and create a highly effective, customized payoff plan. This is especially valuable for those managing multiple high-interest debts.

For those building a financial foundation in the U.S., such as ITIN holders, using a balance transfer for strategic debt management demonstrates financial savvy. It’s a proactive method for optimizing your liabilities and accelerating your journey to being debt-free.

How It Translates to Real Savings

The power of this strategy lies in its precision. Imagine you have three credit cards: Card A with a 3,000 balance at 25% APR, Card B with 4,000 at 22% APR, and Card C with 2,000 at 19% APR. Instead of a scattered approach, you can get a new card with a 7,000 limit and a 0% introductory APR. You could then transfer the full balances from Card A and Card B, the two highest-interest debts.

This move immediately stops the costly interest on $7,000 of your debt. You can then aggressively pay down that consolidated balance while making minimum payments on Card C. This is a practical application of the debt avalanche method, where you save the most money possible by targeting high-interest debt first.

Actionable Tips for Success

To effectively implement this strategic approach, follow these steps:

8. Escape from Predatory Lending Terms

One of the most empowering benefits of a balance transfer is its function as a strategic exit from predatory lending arrangements. This move allows you to transfer debt away from credit cards saddled with exploitative terms, such as excessively high APRs, steep annual fees, or punitive penalty structures, to a new card with transparent and more consumer-friendly terms. By doing so, you effectively sever ties with a product designed to keep you in debt and move toward a healthier financial product.

For those navigating the U.S. financial system, especially ITIN holders who may initially have access to a limited range of credit products, a balance transfer can be a critical step. It provides a pathway from subprime or secured cards with high costs to mainstream, unsecured credit products that offer better protections and opportunities for growth.

How It Translates to Real Freedom

The impact goes beyond simple interest savings; it's about reclaiming financial control. For instance, imagine you hold a subprime credit card with a 2,000 balance at a 35% APR and a 10 monthly maintenance fee. The high rate and recurring fee make it incredibly difficult to reduce the principal. Transferring that balance to a major bank card with a 0% introductory APR and no monthly fee immediately stops the financial drain.

This strategic transfer not only saves you hundreds in interest and fees but also moves you into a more stable and predictable credit environment, a crucial step for anyone looking to build a secure financial future.

Actionable Tips for Success

To successfully escape a predatory card and ensure your new card is a genuine improvement, follow these steps: