Top Banks That Accept ITIN in 2025 – Open Your Account Today

Banking Access for ITIN Holders: Your 2025 Guide

Finding banks that accept ITINs can be a significant hurdle for many individuals in the United States. This meticulously curated list focuses on seven key financial institutions known to offer banking services to ITIN holders in 2025. We'll cut through the confusion and empower you to make informed financial decisions.

This guide provides clear, actionable information to help you compare and choose the best bank for your specific circumstances. We'll delve into the specifics of each bank, outlining key features tailored to ITIN holders. Understanding these nuances is crucial for accessing essential financial tools and building a strong credit history in the U.S.

This list directly addresses the challenges ITIN holders face when seeking financial services. Whether you're a recent immigrant, international student, or freelancer, this information will simplify the process. We'll examine crucial aspects, including:

This article provides a valuable resource for those seeking financial inclusion and stability. We'll cover seven major banks that accept ITINs: Bank of America, Chase Bank (JPMorgan Chase), Wells Fargo, TD Bank, PNC Bank, Citibank, and Capital One. Our goal is to equip you with the knowledge to choose the best bank that accepts ITINs for your unique needs.

1. Bank of America

Bank of America is a prominent choice among banks that accept ITINs, catering to a diverse clientele including non-US citizens and immigrants without Social Security Numbers. This financial giant offers a comprehensive suite of banking services, making it an attractive option for those building their financial footprint in the United States. Their accessibility extends to various demographics, from international students opening their first US bank account to foreign workers on H1-B visas establishing long-term banking relationships. This inclusive approach makes Bank of America a significant player in the financial inclusion landscape.

Why Choose Bank of America?

Bank of America's extensive network of branches and ATMs provides convenience for account holders nationwide. The bank’s robust digital platform, including its mobile app, allows for easy account management, fund transfers, and bill payments. Furthermore, Bank of America offers specialized services like student accounts, potentially offering reduced fees and tailored benefits. For those looking to establish credit, the bank provides various credit-building products that can be explored once an account is opened. These features position Bank of America as a valuable resource for individuals navigating the US financial system.

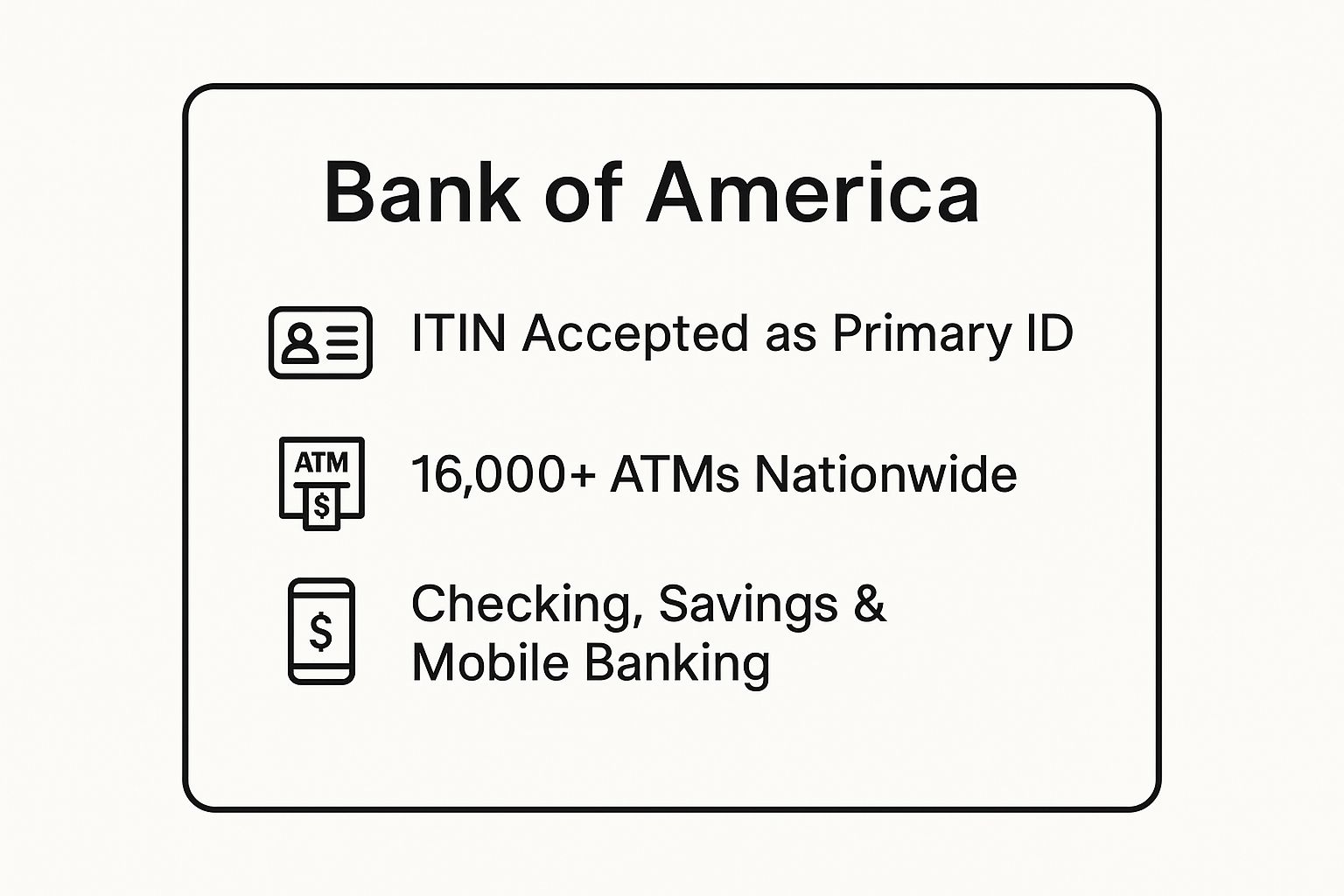

The infographic below summarizes key features of Bank of America for ITIN holders.

As the infographic highlights, Bank of America's acceptance of ITINs as primary identification, combined with its vast ATM network and diverse account options, makes it a practical choice for those new to the US banking system. This accessibility is crucial for financial integration and empowers individuals to manage their finances effectively.

Actionable Tips for Opening an Account

Opening a Bank of America account with an ITIN is a straightforward process. Follow these tips for a smooth experience:

For those unfamiliar with obtaining an ITIN, this resource can provide further guidance: Learn more about how to apply for an ITIN. Bank of America’s commitment to serving individuals with ITINs provides a pathway to financial stability and inclusion within the US financial landscape. This allows recent immigrants and non-citizens to actively participate in the economy and build a secure financial future.

2. Chase Bank (JPMorgan Chase)

Chase Bank, part of JPMorgan Chase & Co., stands as America's largest bank by assets and welcomes ITIN holders. This institution provides comprehensive banking services to individuals without Social Security Numbers. Chase offers both personal and business banking solutions, appealing to a broad range of customers. Their extensive digital capabilities enhance accessibility and convenience for managing finances.

Chase's commitment to financial inclusion extends to various demographics. Foreign nationals working in the US can open business accounts. International contractors can manage US-based income. Immigrants can establish primary banking relationships, all using an ITIN. This makes Chase a crucial resource for those navigating the US financial system.

Why Choose Chase Bank?

Chase's vast network of branches and ATMs nationwide offers unparalleled convenience. Their robust mobile app provides easy account management, transfers, and bill pay. Chase also offers specialized services such as business accounts tailored to entrepreneurs and freelancers. This focus on diverse financial needs positions Chase as a valuable partner for individuals and businesses.

Actionable Tips for Opening an Account

Opening a Chase account with an ITIN is generally straightforward. These tips can help streamline the process:

Chase Bank’s acceptance of ITINs provides a vital pathway to financial integration for those new to the US banking system. This accessibility empowers individuals to participate in the economy and build a secure financial future.

3. Wells Fargo

Wells Fargo is a major American multinational financial services company that welcomes ITIN holders for account opening. This institution offers a range of banking solutions tailored for immigrants and non-US citizens, emphasizing financial inclusion and community banking. Wells Fargo’s presence across the United States makes it accessible to diverse populations, including Hispanic community members, international students, and temporary workers on various visa types. This commitment to serving a broad clientele positions Wells Fargo as a key player in providing financial services to individuals with ITINs.

Why Choose Wells Fargo?

Wells Fargo's focus on community banking often translates to personalized services and localized support. Branches located in diverse communities may offer specialized assistance for ITIN holders, including bilingual staff and culturally relevant financial guidance. The bank’s Opportunity Checking account is specifically designed for those seeking a low-cost banking option, potentially reducing financial barriers for those new to the US banking system. This accessibility and focus on community needs make Wells Fargo a potentially valuable resource for ITIN holders.

Actionable Tips for Opening an Account

Opening a Wells Fargo account with an ITIN can be a positive experience with the right preparation. Here are some practical tips:

For those seeking information on obtaining an ITIN, this resource provides valuable guidance: Learn more about how to apply for an ITIN. Wells Fargo's commitment to financial inclusion and its targeted services for ITIN holders offer a pathway towards establishing a strong financial foundation in the United States. This enables individuals without Social Security numbers to access essential banking services and actively participate in the economy, which is particularly beneficial for those new to the US banking system and seeking banks that accept ITINs.

4. TD Bank

TD Bank, marketed as "America's Most Convenient Bank," stands out among banks that accept ITINs. This institution caters to a diverse customer base, including those without Social Security Numbers. Their focus on accessibility and convenience, particularly with extended hours and weekend availability, makes them an attractive option for individuals navigating the US financial system. This inclusivity resonates with various demographics, from East Coast immigrants to international workers with non-traditional schedules.

Why Choose TD Bank?

TD Bank’s extended branch hours and weekend availability provide unparalleled convenience for account holders. This accessibility is particularly beneficial for those with busy schedules, such as students and young professionals in urban areas. The bank also offers innovative services like Penny Arcade coin-counting machines, adding another layer of convenience. Furthermore, TD Bank provides various account options, including student accounts with potential benefits. These features make TD Bank a valuable resource for those seeking a user-friendly banking experience.

Actionable Tips for Opening an Account

Opening a TD Bank account with an ITIN is designed to be a smooth process. Follow these tips for a seamless experience:

For those unfamiliar with ITINs, this resource can provide further information: Learn more about how to apply for an ITIN. TD Bank’s commitment to serving individuals with ITINs reinforces its dedication to financial inclusion. This allows recent immigrants and non-citizens to actively engage with the US financial landscape and build a secure financial future. TD Bank’s acceptance of ITINs is a key factor in its appeal to those new to the US banking system, making financial integration more attainable.

5. PNC Bank

PNC Bank is a major regional bank that accepts ITINs for account opening, serving customers across multiple states, primarily in the Midwest and East Coast. Known for its innovative banking technology and community focus, PNC provides comprehensive financial services to immigrants and non-US citizens without requiring Social Security Numbers. This makes PNC a valuable option for individuals building their financial lives in the United States. International professionals in PNC’s service areas and tech-savvy users appreciating innovative banking tools will find PNC particularly attractive.

Why Choose PNC Bank?

PNC's Virtual Wallet stands out as a comprehensive money management tool, offering features like spending analysis and budgeting assistance. The bank's mobile app provides convenient access to these tools, empowering users to take control of their finances. Furthermore, PNC often offers fee waivers for accounts with direct deposit, making it a cost-effective choice for many. Establishing multiple account relationships with PNC can also unlock additional benefits, providing further incentive for long-term engagement. PNC’s commitment to financial education further supports customers in navigating the US financial system.

Actionable Tips for Opening an Account

Opening a PNC Bank account with an ITIN is designed to be user-friendly. These tips can streamline the process:

PNC Bank’s acceptance of ITINs as valid identification, along with its digital banking tools and regional presence, positions it as a practical and accessible choice for those new to US banking, particularly within its service area. For those unfamiliar with obtaining an ITIN, this resource provides further guidance: Learn more about how to apply for an ITIN. PNC Bank’s inclusive approach enables recent immigrants and non-citizens to actively engage with the US financial system and build a secure financial future.

6. Citibank

Citibank, part of Citigroup, is a global financial institution with strong international expertise that accepts ITINs for account opening. This makes them a valuable resource for non-US citizens and immigrants without Social Security Numbers. Citibank offers sophisticated banking services designed for global citizens and immigrants building their financial presence in the United States. Their experience serving international customers positions them well to understand the unique needs of this demographic. This includes individuals like international executives managing global finances, high-net-worth immigrants requiring sophisticated services, and professionals with international banking needs. Citibank’s global reach can be a significant advantage for individuals with international financial ties.

Why Choose Citibank?

Citibank's global network and multilingual customer service make it particularly attractive to individuals with international connections. They offer the potential for streamlined international transactions and account management. Features like international account linking and potential global transfer fee waivers can simplify cross-border banking. Premium account options may provide additional benefits tailored to the needs of high-net-worth individuals. This focus on global banking distinguishes Citibank from other institutions that accept ITINs.

Actionable Tips for Opening an Account

Opening a Citibank account with an ITIN is generally a straightforward process. Here are some tips for a smooth experience:

For those unfamiliar with obtaining an ITIN, this resource can provide further guidance: Learn more about how to apply for an ITIN. Citibank’s acceptance of ITINs, coupled with its global focus, makes it a solid choice for those seeking banks that accept ITIN and offer robust international banking capabilities. This provides a valuable entry point into the US financial system for individuals building their financial future in the United States.

7. Capital One

Capital One is a digital-first bank that accepts ITINs for account opening. It focuses on innovative banking solutions and caters to a diverse customer base. Known for its technology-driven approach and customer-friendly policies, Capital One offers convenient and fee-friendly banking options for immigrants and individuals without Social Security Numbers. This makes it a valuable option for those seeking modern financial solutions. Their commitment to digital banking makes them particularly attractive to tech-savvy individuals.

Why Choose Capital One?

Capital One's emphasis on digital banking provides a seamless and user-friendly experience. The bank's robust mobile app allows for easy account management, fund transfers, and bill payments from anywhere, anytime. This is particularly beneficial for those new to the US banking system, providing a convenient way to manage finances. Furthermore, Capital One offers a range of no-fee checking and high-yield savings accounts, minimizing costs and maximizing returns.

Capital One's focus on technology and accessibility makes it a strong choice for various demographics. Tech-savvy immigrants preferring digital banking can benefit from the user-friendly app and online services. Young professionals seeking to avoid traditional banking fees will find the no-fee options attractive. International students looking for fee-friendly banking solutions can establish accounts easily with their ITINs. This inclusivity further solidifies Capital One's position as a valuable resource for ITIN holders.

Actionable Tips for Opening an Account

Opening a Capital One account with an ITIN is designed to be a streamlined process. Follow these tips for a smooth experience: