Banking Without Social Security Number: Your Guide

Let's cut right to the chase: You can absolutely open a U.S. bank account without a Social Security Number. It’s a common misconception that an SSN is a hard-and-fast requirement, but I’ve seen countless non-citizens, international students, and others successfully navigate the system.

The secret isn't finding some obscure loophole. It’s simply knowing what documentation banks will accept as an alternative, like an Individual Taxpayer Identification Number (ITIN) or even just a valid foreign passport.

Your Path to Banking Without a Social Security Number

Many people hit a wall when they try to open a bank account, assuming the lack of an SSN is a dealbreaker. This belief keeps a lot of individuals who are legally in the country from accessing basic financial services. But the reality on the ground is far more flexible than you might think.

At the end of the day, banks just need to verify who you are. They have to comply with federal regulations like the Patriot Act and "Know Your Customer" (KYC) rules. An SSN is the most common way they do this, but it's certainly not the only way.

The ITIN: Your Best Alternative

For anyone without an SSN, the most powerful tool in your arsenal is the Individual Taxpayer Identification Number (ITIN). This is a tax processing number issued by the IRS for certain nonresident and resident aliens who can't get an SSN.

From a bank’s point of view, an ITIN fulfills the exact same identity verification function as an SSN.

For many people, getting an ITIN is the first real step toward building a financial life in the United States. It’s the key that unlocks not just a bank account, but often the ability to build a credit history, too.

What if You Don't Have an ITIN?

What about other options? If you don't have an ITIN—or don't qualify for one—some banks are still willing to work with you, especially if you're in the U.S. for a shorter period, like for business or tourism.

In these situations, they'll usually ask for a combination of other documents. You’ll have the best luck if you can provide:

A word of caution, though: this approach can be hit-or-miss. Policies can change dramatically from one bank to the next, and sometimes even between different branches of the same bank. The ITIN is, without a doubt, the most reliable and widely accepted alternative. It provides a much clearer, more consistent path to getting an account opened.

Understanding Your Identification Alternatives

So, how do you prove who you are to a bank when you don't have a Social Security Number? It’s a common question, and the answer isn't about finding a secret loophole. It's about knowing the established, legitimate alternatives that banks use every day.

Financial institutions in the U.S. have a legal duty to verify the identity of anyone opening an account. This is all part of the federal "Know Your Customer" (KYC) regulations, which are in place to clamp down on fraud and money laundering. An SSN is the most common way they do this, but it’s certainly not the only one.

The Power of the ITIN

Your most powerful tool for banking without an SSN is the Individual Taxpayer Identification Number (ITIN). Think of it as your golden ticket.

An ITIN is a nine-digit number issued by the Internal Revenue Service (IRS) for tax processing purposes. It’s specifically designed for people who need to file a U.S. tax return but aren’t eligible for an SSN. From a bank's perspective, an ITIN is just as good as an SSN—it’s a unique, official identifier that proves you're registered in the U.S. tax system.

Getting an ITIN should be your top priority if you plan to live or work in the U.S. for any length of time. To get started, you’ll need to submit Form W-7 to the IRS along with your federal income tax return and documents that prove your identity. For a deep dive, you can learn more about what an Individual Taxpayer Identification Number is and how it all works.

Other Accepted Forms of Identification

While an ITIN is the best-case scenario, it's not always the only way in. If you're still in the process of getting one, many banks will accept a combination of other documents to satisfy their KYC requirements.

Here are a few of the most common documents banks will ask for:

One quick but crucial tip: make sure any document from your home country is current. For instance, you’ll want to ensure your Nigerian passport is up-to-date before walking into a bank to avoid any hitches. An expired ID is a guaranteed dead end.

This flexibility is a huge move toward making banking more accessible for everyone. While an ITIN doesn't grant access to public benefits, its acceptance by major banks allows immigrants to build a financial foundation. By using ITINs, foreign passports, or Alien Identification Card Numbers, banks can meet their anti-money laundering obligations while opening their doors to more people.

Gathering the Right Documents for Your Application

Walking into a bank unprepared is one of the quickest ways to get a "no." When you're trying to open an account without a Social Security number, having all your ducks in a row from the start makes all the difference. Think of it as building a strong case for your identity—the more solid, official proof you can provide, the smoother things will go.

First up, banks will always ask for a primary, government-issued photo ID. For non-U.S. citizens, the absolute best document you can have is a valid foreign passport. And I mean valid—an expired passport will stop the conversation right in its tracks. Other strong options include an Alien Identification Card (often called a Green Card) or a consular ID card.

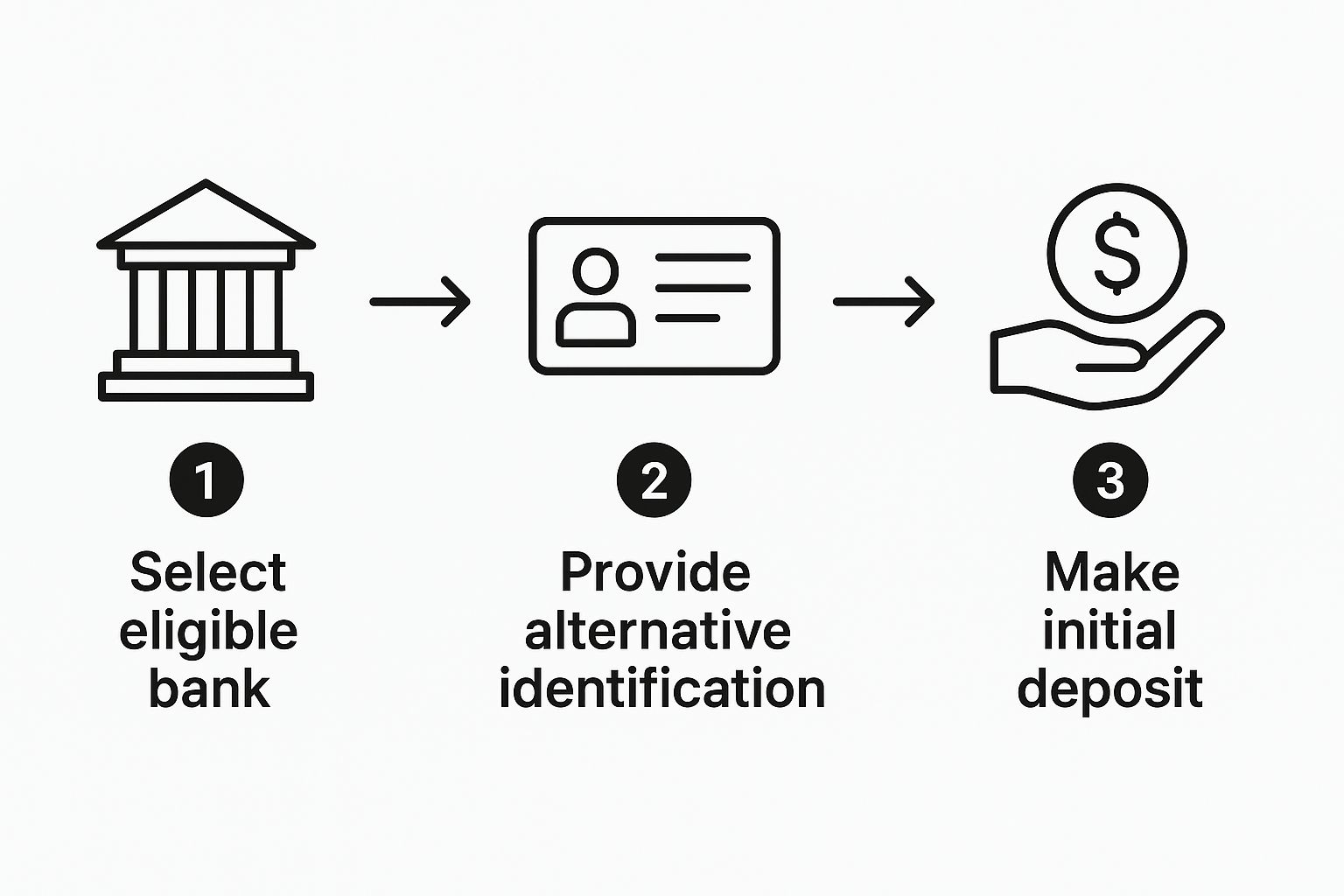

This simple graphic nails it: providing that alternative ID is the key step that connects you from choosing a bank to actually funding your new account.

Proving Where You Live

Next, you absolutely must prove you have a U.S. address. This is a non-negotiable step for any financial institution, mainly due to federal regulations. A simple verbal confirmation won't work; you need official documentation.

A few common documents that work well are:

The ITIN and Supporting Paperwork

If you have an Individual Taxpayer Identification Number (ITIN), bring the official CP565 notice from the IRS that assigned you the number. While the bank is primarily interested in the number itself, having that original letter adds a strong layer of credibility to your file. If you're still in the process of getting one, you can learn more about the paperwork involved in our guide on https://www.itinscore.com/blog/itin-application-requirements/.

To help you organize everything, here's a quick checklist of the documents banks typically ask for.

Document Checklist for Opening an Account Without an SSN

Having these documents ready to go shows the bank you're an organized and serious applicant. It instantly builds trust and makes their job of verifying your identity that much easier.

Remember, you'll be handling some very sensitive information. While banks have robust security, it's always wise to be familiar with secure document sharing strategies for your own peace of mind. By preparing this portfolio of documents, you're not just applying—you're presenting a complete, credible profile.

Finding the Right Bank: Where to Go When You Don’t Have an SSN

Let's be honest: trying to open a bank account without a Social Security Number can feel like hitting a wall. But the reality is, not all banks have the same rigid rules. The trick is knowing where to look. While some banks might give you an immediate "no," plenty of others have well-established pathways for ITIN holders and other applicants without an SSN. Knowing which ones these are will save you a ton of time and frustration.

Often, your best bet is to start with the big national players. Giants like Bank of America, Chase, and Citibank have a long history of being ITIN-friendly. Why? Because they operate in diverse communities all over the country, and their internal systems are already set up to handle different kinds of identification.

The Big National Banks

When you're starting your search, the large, household-name banks are a solid first stop. They tend to have standardized procedures, which means the staff are more likely to have seen an ITIN application before and won't be caught off guard.

A few of the most well-known options include:

Even with these big names, policies can sometimes differ slightly from one branch to the next. I always recommend making a quick phone call before you head over. It can save you a wasted trip and confirm exactly what you need to bring.

Don't Overlook Local Banks and Credit Unions

While the national banks offer predictability, you shouldn't write off the smaller guys. Local community banks and credit unions can be hidden gems. These institutions often pride themselves on a more personal touch. You might find that a branch manager at a local bank has more leeway to work with your specific situation, especially if you can build a bit of a relationship.

Credit unions are another fantastic option. They are member-owned, which means their main focus is serving their community, not just turning a profit. I've found they can be more flexible and willing to look at your whole financial story instead of just one number.

This question gets right to the point. It ensures you're talking to the right person and that you won't show up unprepared. It's a simple step that can turn a potentially stressful process into a smooth one.

What About Online Banks and Fintech?

The world of digital banking is also creating new opportunities. A growing number of online-only banks and financial technology (fintech) companies are specifically catering to international clients and non-U.S. residents. These digital platforms are often built from the ground up to accept different forms of identification.

The demand for these services is huge. One report found that 98% of non-resident applicants looking for a U.S. bank account were doing so without an SSN or ITIN. While many of these are foreign businesses making large deposits, it points to a much bigger trend of banks adapting to a global customer base.

Getting a bank account is a massive first step. It also opens the door to other financial goals, like building credit. Once your account is set up, you'll probably start thinking about what comes next. You can learn more by checking out our guide on how to get credit cards without a Social Security number.

Dealing with International Accounts and Large Deposits

If you're an expat, a global investor, or someone who needs to deposit a significant amount of cash, a standard U.S. checking account probably won't cut it. Your financial life stretches across borders, and that calls for a more sophisticated banking solution.

This is where international accounts enter the picture. They are specifically built for people whose financial needs are a bit more complicated than the average person's. You'll find these accounts at the big multinational banks—the ones that already know the ins and outs of serving non-residents. For them, banking without a Social Security number is just business as usual.

What Makes These Accounts Different?

When you start digging into these specialized accounts, you’ll see they offer way more than your basic checking or savings. They’re designed from the ground up to make managing money across different countries and currencies feel seamless.

You can usually expect some really useful perks:

Knowing the Trade-Offs

While the benefits are great, these accounts operate on a different level, and so do their requirements. It's really important to know what you're getting into before you commit. For starters, these premium services aren't cheap.

You should also brace yourself for some intense scrutiny during the application process. Banks that offer these accounts are extremely careful about following global anti-money laundering laws. That means you'll face more paperwork and more pointed questions about where your money is coming from.

Several big global banks are well-equipped for this. HSBC USA, for instance, is known for allowing non-residents to open accounts using foreign documents instead of an SSN. They have services like their Global View and Global Transfers that make cross-border banking much easier.

But these perks come with higher fees, substantial minimum balances, and potential tax headaches in both the U.S. and your home country. You can find more details on how these specialized accounts work on DSGPay.com. It’s a path that offers a ton of convenience but absolutely requires careful financial planning.

Common Questions About Banking Without an SSN

Even when you've got all your documents lined up, some questions are bound to pop up. It's a path less traveled, after all. Let's walk through some of the most common hurdles and clear them up so you know exactly what to expect.

Can I Just Open an Account Online?

I get this question all the time. While it would be convenient, opening a bank account without an SSN is almost always an in-person job. Traditional banks need to physically verify your documents—like your passport and ITIN letter—to satisfy the federal "Know Your Customer" (KYC) rules.

Sure, some newer online banks and fintech apps are trying to serve non-residents, but your surest bet is still a face-to-face visit at a local branch. A quick tip from experience: always call the specific branch you plan to visit first. Confirm they handle ITIN applications and ask exactly what to bring. It'll save you a ton of time.

Will This Actually Help Me Build U.S. Credit?

A simple checking or savings account won't do it on its own. Banks don't report your account balance or debit card usage to the credit bureaus, so it doesn't directly build your credit history. But don't underestimate its importance—it's the essential first step.

The real win here is that many of the banks that open accounts for ITIN holders also offer secured credit cards. You put down a small deposit, and they give you a credit card with a limit matching that deposit. Use it for small purchases, pay it off every month, and that payment history gets reported to the credit bureaus. This is how you start building a real U.S. credit score with just your ITIN.