Understanding the Average Credit Limit

The idea of an "average credit limit" can be a bit misleading. There isn't a magic number that applies to everyone. Instead, think of your credit limit as a direct reflection of your personal financial journey. It’s the amount of trust a lender is willing to extend to you, and that trust is built on your income, credit history, and even your age.

Naturally, a college student just starting out is going to have a very different credit limit than someone who's been in their career for 20 years.

What Is a Typical Credit Limit?

When a bank decides on your credit limit, they're really just calculating risk. They're asking, "How likely is this person to pay us back?" A higher limit isn't just a bigger spending account; it's a vote of confidence from the lender in your financial responsibility.

On the flip side, a lower limit might mean you have a shorter credit history, a lower income, or maybe a few financial bumps in your past. It's the bank's way of playing it safe while still giving you a chance to build that financial trust over time. This is exactly why a solid, positive credit history is your most powerful tool.

Factors That Shape Your Limit

While every lender has its own secret sauce for calculating credit lines, they all look at the same handful of core ingredients from your financial life. They’re piecing together a puzzle to see the full picture of you as a borrower.

Here’s a quick look at the factors that carry the most weight when a lender is making a decision about your credit limit.

Quick Look At Factors Influencing Your Credit Limit

Ultimately, these elements combine to give the lender a snapshot of your financial health, which they then use to set a limit that they feel is appropriate and manageable for both you and them.

Generational Trends in Credit Limits

It’s also interesting to see how the average credit limit shifts across different age groups. This makes sense, as income and the length of a person's credit history tend to grow over time. The latest data reveals a clear upward trend in credit limits for everyone.

For instance, between 2021 and 2022, the average credit limit for Gen Z jumped by 14.5% to 11,290**. Millennials saw a similar boost, with an **11.4%** rise to **24,668. Gen X, already more established, experienced a 6.8% increase to $35,994.

These numbers, which you can dig into further in FinanceBuzz's analysis of generational credit trends, tell a story: as people advance in their careers and prove their creditworthiness over the years, their borrowing power expands right along with them.

How Lenders Decide Your Credit Limit

When you apply for a credit card, the limit you're given isn't just a random number. Lenders are making a calculated bet on you, and they piece together a detailed puzzle of your financial life to figure out how much they can safely lend.

Think of it like an insurance company sizing up a driver. A driver with a perfect record and a safe car is a good risk and gets a better rate. In the same way, a borrower with a solid financial track record is seen as less risky, which usually translates into a higher credit limit.

Ultimately, every piece of information on your application helps the lender answer one big question: "How much credit can this person actually handle?"

The Pillars of Your Creditworthiness

Lenders look at a handful of key factors when making their decision. While every bank has its own secret sauce, the main ingredients they use are surprisingly consistent across the board. If you understand what they’re looking at, you’re in a much better position to get the limit you want.

First and foremost is your credit history and score. Your FICO Score, which runs from 300 to 850, is like a quick snapshot of your financial reliability. According to Experian, the average FICO Score in the U.S. was 715 in 2024, which is considered "good."

This one number tells a powerful story about how you've handled debt in the past. A higher score signals a history of paying your bills on time and managing credit well, making you a much more appealing candidate.

Income and Debt Analysis

Your credit score is only part of the story. Lenders also need to be sure you have the cash flow to handle new debt. This is where your income and your existing financial commitments come into play. Your income is the engine that shows you have the power to make payments.

But income on its own doesn't give the full picture. Lenders will immediately look at your debt-to-income (DTI) ratio. This number compares how much you owe each month to how much you earn before taxes.

If your DTI is high, it tells the lender that a big chunk of your paycheck is already spoken for, leaving very little wiggle room. Most lenders want to see a DTI ratio below 36%. This shows them you aren't stretched too thin and can comfortably take on a new line of credit.

A few other critical factors they'll look at include:

The Role of the Credit Product

Finally, the specific card you apply for makes a huge difference. You can't expect a premium travel rewards card's limit on an entry-level student card or a secured card. The starting limits are just in different leagues.

Premium cards are built for people with higher incomes and excellent credit, so their higher limits reflect the kind of spending that's expected. Your relationship with the bank also plays a part. If you've had a checking or savings account with them for years and have kept it in good standing, they might be willing to offer you a more generous credit line right out of the gate.

How Does Your Credit Limit Compare?

Knowing your credit limit is useful, but how do you know if it's actually any good? That's where benchmarking comes in. It’s not about keeping up with the Joneses; it's about getting a clear-eyed view of where you stand financially.

Think of it as adding context to the numbers. Seeing the average credit limit for people with a similar financial picture can help you set realistic goals and figure out what’s possible as your own situation improves.

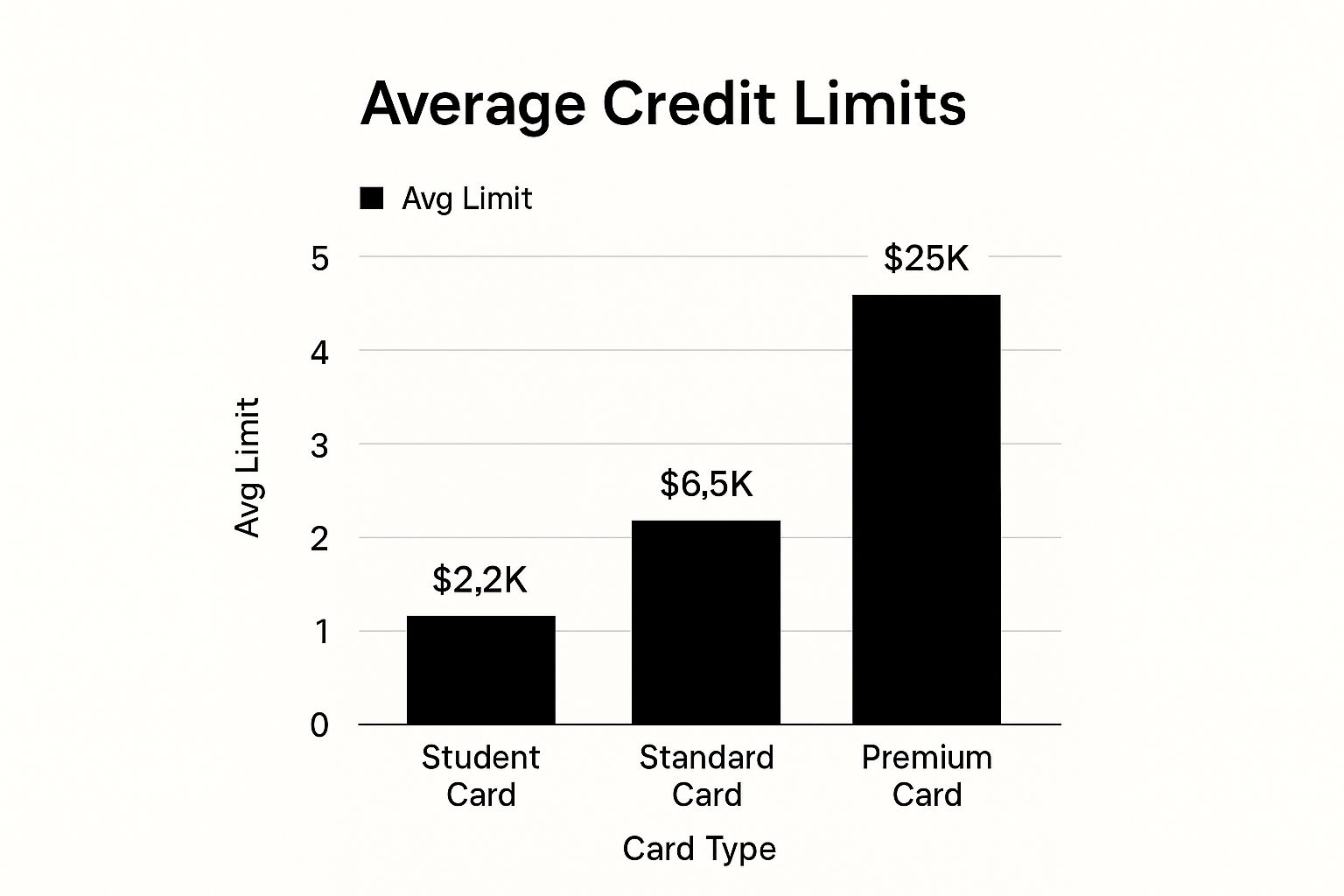

The chart below shows just how much average limits can vary depending on the type of credit card you have.

It’s pretty clear that premium cards meant for high earners come with much higher limits than your standard or student cards. This just reflects the different financial realities of the people they’re designed for.

The Big One: How Your Credit Score Shapes Your Limit

If there's one single factor that has the biggest impact on your credit limit, it's your credit score. To a lender, a high score is a big green flag that says you're a reliable borrower. That trust translates directly into how much credit they're willing to offer you.

Lenders often group people into different tiers based on their FICO® Score.

The difference can be staggering. A super-prime borrower might easily have an average credit limit of 12,000** on a single card, while someone in the subprime category might be looking at something closer to **1,500.

Average Credit Limit By Credit Score And Generation

It’s not just about your score. Your age and generation also tell a story about your financial journey, which gets reflected in your credit limit. We can see this play out when we look at how credit scores and generational cohorts intersect.

The table below breaks down the average credit limits across different age groups and FICO score ranges, giving a more detailed picture of what’s typical.

As you can see, both a higher credit score and being in an older generation with more time to build credit and income contribute to higher average limits. It’s a combination of proven financial responsibility and life stage.

This idea of checking your numbers against industry standards isn't unique to credit. People do it all the time with their paychecks using salary benchmarking tools.

Ultimately, a higher limit can be a great tool for your financial health, especially for keeping your credit utilization low. But it’s a tool that requires smart handling. If you want to see how different balances can affect your score, playing around with a credit utilization ratio calculator can be incredibly insightful.

Actionable Steps to Increase Your Credit Limit

Knowing how your credit limit is set is one thing, but actually taking control of it is where the real power lies. Boosting your borrowing power isn't about some secret trick or a stroke of luck—it's about a consistent, smart approach to handling your money. Think of it as training for a financial marathon, not just sprinting for a quick fix.

You've really got two main ways to get a higher limit: you can ask your issuer directly, or you can play the long game by improving your overall financial health. Both work, and honestly, using them together is your best bet for success.

The Direct Approach: How to Ask for an Increase

Sometimes, the most straightforward path is the best one. Just ask for a higher limit. Credit card companies are businesses, after all. If you've proven yourself to be a responsible customer, they're often more than willing to extend you more credit. Before you make that call or log into your account, though, you want to make sure your financial ducks are in a row.

Here’s a quick checklist to run through before you make the request:

Long-Term Strategies for a Higher Limit

A direct request can give you a quick win, but the most reliable way to build a truly high average credit limit is to methodically strengthen your entire credit profile over time. These habits prove to lenders that you are a low-risk, high-value customer who they can trust with more credit.

Start with the foundation: your credit score. Since your payment history makes up a massive 35% of your FICO Score, making every single payment on time is non-negotiable. Seriously. Set up autopay or calendar alerts so you never, ever miss a due date.

Next, get obsessed with your credit utilization ratio. This metric compares how much you owe to your total credit limits, and it accounts for another 30% of your score. The golden rule is to keep your utilization below 30%, but if you can push it under 10%, your score will thank you.

Finally, show them you know how to handle the credit you already have. Use your card regularly for small purchases you can easily manage, and then pay the balance in full every month. This activity signals to your issuer that you're an engaged and responsible cardholder. For a much deeper look, check out our guide on strategies for increasing your credit limit.

This long-term game plan builds a foundation of trust that doesn't just lead to higher limits on one card—it opens doors to better loans, mortgages, and financial products across the board. In a country with over 631 million active credit card accounts, proving your financial reliability is how you stand out. The U.S. credit market has seen a 26.2% jump in active accounts since 2021, which shows just how vital credit has become for financial life, as detailed in this analysis of U.S. credit card statistics.

Building Credit with an ITIN

For the millions of people in the U.S. who use an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number, the credit-building journey can feel like it has a few extra twists and turns. The fundamentals of good financial habits are universal, but ITIN holders often run into specific roadblocks, like finding lenders who are set up to work with them.

The good news? Building a great credit history and securing a healthy credit limit is absolutely within reach. Think of it like taking a scenic route to the same destination—it just requires a slightly different map. The trick is to be smart and deliberate right from the start.

Starting Your Credit Journey

Your first mission is to find financial institutions that are ITIN-friendly. Not every bank or credit union has the process down for applications without an SSN, so a little research upfront saves a lot of headaches later. Start by looking at community banks, local credit unions, and even some larger national banks that are known for working with diverse communities.

Once you find a place that's a good fit, your next move is to build a relationship. Simply opening a checking or savings account can be a game-changer. It gets your foot in the door, establishes you as a customer, and shows the bank you're financially stable—all things that make them more comfortable extending you credit later on.

Strategies for Growth and Higher Limits

Once you have that first account—like a secured card—your entire focus should be on creating a perfect track record. Your payment history is, without a doubt, the heaviest hitter when it comes to your credit score.

Following these steps consistently builds a powerful, positive history that proves you're a reliable borrower. Before you know it, that consistent effort can help you graduate to an unsecured card and open the door to a much higher average credit limit. For a deeper dive, check out our complete guide on how to build credit with an ITIN number.

The Hidden Risks of a High Credit Limit

Getting approved for a high credit limit can feel like a major financial victory. And in many ways, it is. More borrowing power can lower your credit utilization and act as a crucial safety net for emergencies. But it’s a double-edged sword.

Think of a high credit limit as a powerful tool. It’s incredibly useful when you manage it with care, but it can be dangerous if you’re not careful. The biggest risk is purely psychological—the temptation to overspend.

When you have a large amount of credit just sitting there, it’s easy to get a false sense of financial security. That feeling can make it tempting to justify purchases you can't really afford right now. What begins as a small, one-time splurge can quickly snowball into a habit of spending well beyond your means.

This pattern leads straight into the next major pitfall: racking up high-interest debt. When you start carrying a large balance from one month to the next, the interest begins to compound, quickly turning a manageable purchase into a heavy financial weight.

The True Cost of High Balances

When your spending gets ahead of your ability to pay it off, debt can spiral out of control faster than you'd think. The national average credit card debt for people carrying a balance recently jumped to $7,321, which is a 5.8% increase in just one year.

At the same time, the average credit card APR has climbed to a dizzying 21.16%. With rates that high, it's incredibly difficult to make a dent in your principal balance. You can dig into more of this data with the latest U.S. credit card debt statistics from LendingTree.

It’s essential to view your credit limit as a responsibility, not just extra cash to spend. It's about building a healthy, sustainable financial future, not just enjoying a temporary boost in purchasing power. The key is to stay in control and make sure your spending lines up with your budget, not your credit limit.