Get an Auto Loan with ITIN Number – Easy & Quick Guide

It's a misconception I hear all the time: you can't buy a car in the United States without a Social Security Number. Let me set the record straight—getting an auto loan with an ITIN number is entirely possible. I've seen it happen countless times, and this guide is designed to walk you through exactly how to do it.

Yes, You Can Finance a Car with an ITIN

Trying to secure a car loan without an SSN can feel like hitting a brick wall, but it’s a wall millions of people have successfully broken through. Your key is the Individual Taxpayer Identification Number (ITIN). Think of it as an alternative ID for tax purposes, issued to people who aren't eligible for an SSN, like many foreign professionals, students, and other non-residents.

The market is catching up. As more ITIN holders have needed financing, a growing number of car dealerships and lenders have started adapting. These institutions now recognize the ITIN on loan applications, opening up a path to car ownership for anyone who can prove they're a reliable borrower. You can find out more about how lenders are adapting to ITIN car loans and see how the landscape is shifting.

Who Typically Qualifies for an ITIN Auto Loan?

So, is this the right path for you? An auto loan with an ITIN number is generally aimed at people who are living and working here but don't have an SSN. In my experience, this usually includes:

The real challenge isn't the ITIN itself. It's proving you're financially responsible without a long, SSN-based credit history. Lenders just want to see solid evidence that you can, and will, pay back the loan.

To better understand the process, it helps to see how applying with an ITIN compares to a traditional SSN application.

ITIN vs SSN Auto Loan Application At a Glance

This table breaks down the main differences you'll encounter. While the end goal is the same, the path for an ITIN holder requires a bit more preparation with alternative documentation.

As you can see, the core requirements—proving who you are and that you can pay—are the same. The difference lies in how you prove it.

Don't worry, we're going to break down this entire process step-by-step. From building a strong financial profile to finding the right lender and getting your documents in order, you'll have everything you need to get behind the wheel. Your ITIN is a perfectly good key to start the engine.

Laying the Groundwork: Building a Strong Financial Profile for Your Application

Getting approved for an auto loan with an ITIN number isn't something that happens overnight. The real work begins long before you ever step foot in a dealership. Lenders are fundamentally looking for one thing: proof that you're a reliable borrower. Since you might not have a long credit history, you'll need to paint a clear picture of your financial stability in other ways.

Your first move should be to open a U.S. bank account—both checking and savings. This does more than just give you a place to store your money; it creates a verifiable financial trail. When you apply for a loan, lenders will scrutinize your bank statements to verify your income and get a feel for your financial habits.

It’s incredibly important to maintain a healthy, consistent balance. Try to avoid letting your accounts dip too low or hit zero. What you're aiming for is a solid three to six months of consistent deposits that show a stable, or even better, a growing balance. This sends a powerful signal to lenders that you manage your money well and aren't living hand-to-mouth, which makes you a much lower risk in their eyes.

Show Lenders You’re Reliable with Payments

Without a traditional credit score, your everyday bills become your best evidence of creditworthiness. Lenders need to see that you consistently meet your financial commitments, big or small. In a way, you can think of your monthly bills as stand-ins for a formal credit report.

Make it a priority to get all your utility bills—like electricity, gas, water, internet, and your cell phone—registered in your name. Then, pay them on time, every single time. Keep good records of these payments, because many ITIN-friendly lenders are willing to look at this kind of alternative data to assess your application. This track record shows you can handle the responsibility of a recurring monthly payment, which is exactly what a car loan is.

Take Control by Actively Building Your Credit

While paying your bills on time is a great start, you can be even more proactive in building a credit history linked to your ITIN. A secured credit card is one of the most effective tools for the job. It works by having you put down a small cash deposit, often around $300, which then acts as your credit limit.

Use this card for small, everyday purchases you'd be making anyway—think groceries or gas. The key is to pay the balance in full every month without fail. Before you apply, confirm that the card issuer reports your payment activity to all three major credit bureaus (Experian, Equifax, and TransUnion). This process builds a positive payment history that's directly tied to your ITIN. For a more detailed guide, check out our post on how to build credit with an ITIN number.

Finally, a stable home address and consistent proof of income are absolutely essential. Lenders need to confirm you're settled and have a dependable way to make your loan payments. When you combine a steady residence, a reliable income, and a proactive approach to demonstrating your financial health, you significantly boost your odds of driving away in that new car.

Get Your Paperwork Ready for a Smooth ITIN Loan Process

Walking into a dealership prepared can mean the difference between getting a quick "yes" and facing a frustrating, drawn-out process. When you're using an ITIN number to apply for a car loan, having all your documents in order from the start sends a powerful message to the lender: you're organized, serious, and a reliable borrower.

Think of it like building a case for yourself. Before you even think about test-driving cars, your first mission is to get your document portfolio assembled. Lenders need to confirm who you are, how you earn your money, and where you live. Getting this done upfront saves a ton of time and starts your relationship with the lender on a foundation of trust.

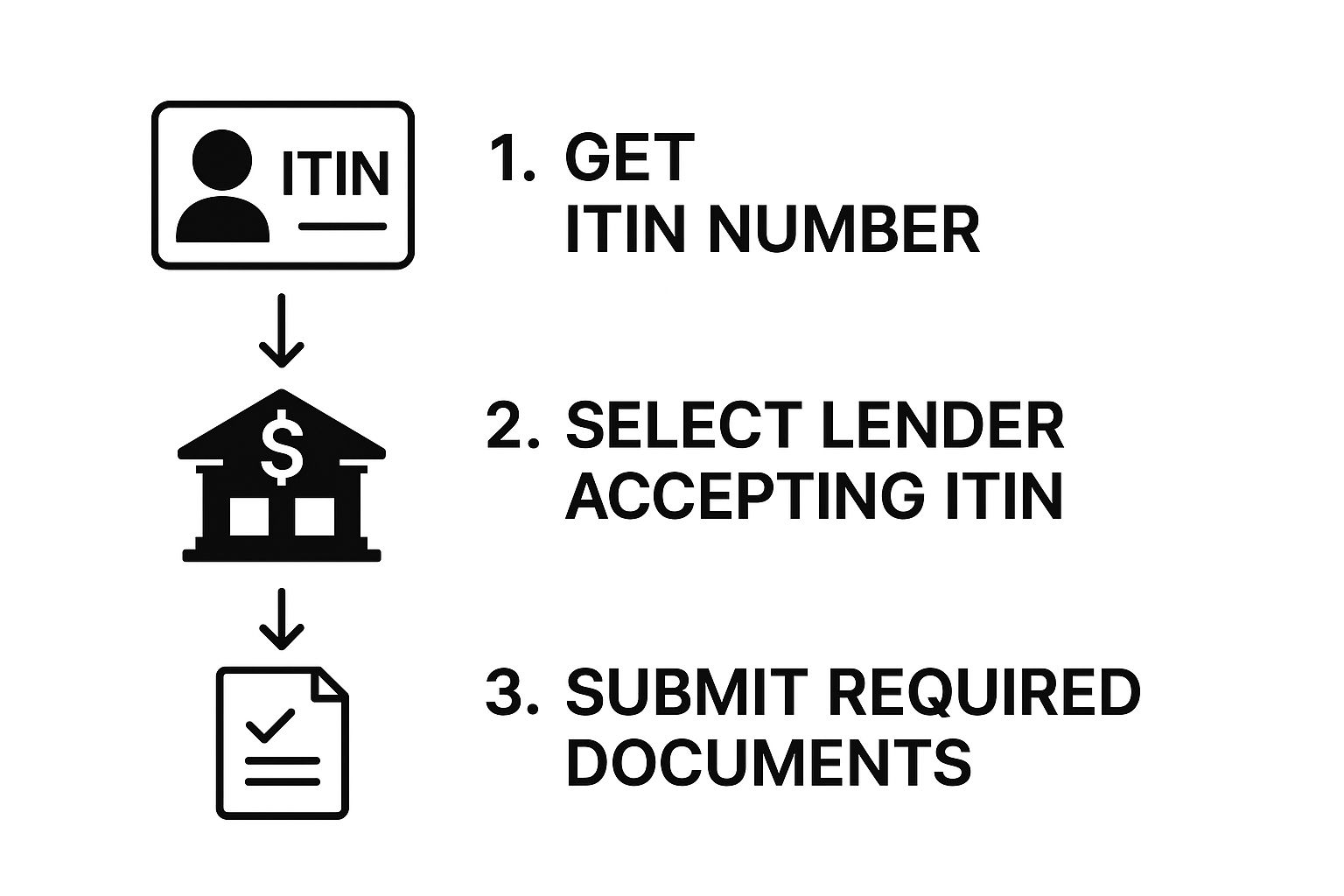

This graphic gives you a bird's-eye view of the journey, from securing your ITIN to having your documents ready for the lender.

As you can see, submitting your documents is one of the final hurdles before a decision is made. It’s a critical step, which is why making sure everything is accurate and complete is so important.

The Essential Document Checklist

Let's get specific about what you need to have in your folder. Every piece of paper has a job to do in painting a clear picture of your financial life for the lender.

Proof of Identification

This one is non-negotiable. You’ll absolutely need at least two forms of valid, unexpired identification to prove you are who you say you are.

Proof of Income

Lenders need confidence that you can comfortably handle the monthly car payment. The more evidence you can show of steady income, the stronger your application will be.

Proof of Residency

The lender needs to verify your current address. Make sure the address you use on your application matches what’s on these documents. Consistency is key.

Personal References

It's a good idea to have a list of personal references ready, just in case. Some lenders will ask for them. These should be people who know you well but aren’t family members living in the same house. Think friends, coworkers, or a manager.

Prepare a neat list with the names, addresses, and phone numbers of three to five reliable contacts.

Once you have everything, organize it all in a folder. Showing up this prepared makes you look like a pro and can dramatically smooth out the bumps on the road to getting your auto loan with an ITIN number.

Finding Lenders That Welcome ITIN Holders

Alright, you've got your finances in order and your documents are ready. Now comes the real hunt: finding the right financial partner. This is a big one, because not every bank or dealership is set up to handle an auto loan with an ITIN number. Knowing where to look is what separates a smooth process from a frustrating dead end.

You'll want to focus on institutions known for their flexible underwriting. Many of the huge, national banks have strict, automated rules that are tied exclusively to Social Security Numbers. The real opportunities often lie with lenders who have built their businesses by serving diverse communities. These are your best bets.

Where to Begin Your Lender Search

Think beyond the big-name banks. I've seen countless ITIN holders find success by taking a more targeted approach. You're looking for lenders who value community relationships over a simple, one-size-fits-all approval algorithm.

Here’s where I’d start looking:

Vet Potential Lenders Like a Pro

Getting a "yes" is just the start. You need to make sure you're partnering with a trustworthy lender, not a predatory one. A little homework upfront can save you a world of hurt later on.

A quick phone call can tell you everything you need to know and help you sidestep lenders who prey on ITIN holders with sky-high interest rates.

When you call, be direct. Ask them straight up: “Do you offer financing for customers using an ITIN number?” If they pause or sound confused, just thank them and move on. If they give you a confident "yes," you can dig deeper into their process. For a full rundown of what to ask, check out our guide to different ITIN loan options.

Some financing companies have really simplified this experience. Dealerships specializing in auto loans for ITIN holders often have much clearer application paths. They’ll have transparent guidelines and accept ITINs for both new and used car financing at fair rates. It’s an inclusive approach that breaks down the usual barriers.

By focusing your search on these types of institutions and asking the right questions, you'll find a reliable partner who sees you as a person, not just an application.

Alright, you’ve done the hard work of getting your documents in order and found a lender who understands ITIN financing. Now comes the exciting part: applying for the loan and getting the best deal possible. This is where all that prep really shines.

From Application to Approval

When you sit down with the loan application, you'll need to be meticulous. You'll almost certainly see a field for a Social Security Number. Go ahead and put your nine-digit ITIN in that box. It's a smart move to also tell the loan officer, "Just so you know, I'm using my ITIN," to prevent any hiccups in the system. Make sure every single detail you provide is accurate—any inconsistencies can slow things down or raise unnecessary questions.

Your Best Bargaining Chip: The Down Payment

When it comes to negotiation, nothing speaks louder than a strong down payment. If you can put down 20% or more of the car's price, you instantly become a much stronger applicant. Why? Because it proves you're financially committed and immediately reduces the amount of risk the lender is taking on.

This isn't just about making the lender feel good; it directly benefits your wallet. A bigger down payment often unlocks a lower interest rate, saving you a substantial amount of cash over the long haul.

Let's break it down with a real-world example for a $25,000 car:

See the difference? Putting down an extra $2,500 not only drops your monthly payment but can also convince the lender to give you a better rate. You have more power in this process than you might think.

Know Your Loan Agreement Inside and Out

Once an offer is on the table, slow down. Before a single signature hits the paper, you need to understand exactly what you're agreeing to. Don't let anyone rush you. Have the loan officer walk you through anything that seems unclear.

Pay close attention to these three key components:

And if you're wondering whether this is all worth it, the numbers speak for themselves. Back in 2022, Beneficial State Bank alone had 1,247 auto loans out to ITIN borrowers, totaling nearly $33.69 million. This isn't a niche market anymore; it's a clear sign that lenders recognize the reliability of ITIN holders. You can discover more about the growth of ITIN auto lending and see how opportunities are expanding.

By negotiating with confidence and carefully reviewing the fine print, you’re not just getting a set of keys. You’re making a savvy financial move that builds a stronger future.

Common Questions About ITIN Auto Loans

Even with a solid plan, you're bound to have questions when you're trying to get an auto loan with an ITIN number. It’s completely normal. Let's tackle some of the most common concerns I hear from people so you can move forward with confidence.

Walking through this process often brings up practical worries about costs, what your options are down the road, and how major life changes might impact your loan. Getting straight answers now helps you prepare for what's ahead.

Will My Interest Rate Be Higher with an ITIN Number?

This is probably the biggest question on everyone's mind. The short answer is: not necessarily. Your interest rate is tied to financial risk, not the type of ID you use. While it's true some lenders might start with a higher quote, you can absolutely secure a competitive rate by building a strong financial profile.

What lenders really care about is your ability to reliably pay back the loan. To get a better rate, you need to show them you're a low-risk borrower.

Here’s how you do that: