Add Authorized User to Build ITIN Credit

If you have an ITIN and are looking to build a credit history, becoming an authorized user on someone else's credit card is one of the most effective shortcuts available. Think of it as "borrowing" the positive history from an existing, well-managed credit account. When a primary cardholder with a great track record adds you, their responsible habits can start showing up on your credit report, giving you a powerful head start.

How the Authorized User Strategy Works for ITIN Holders

The idea is straightforward: you get the benefits of a credit account without being the one legally on the hook for the debt. For an ITIN holder, this is a game-changer. It lets you sidestep the formal credit application process, which is often a major roadblock when you don't have an established U.S. credit file to begin with.

Instead of building a credit history from scratch, which can take years, you get to piggyback on someone else's. When the primary cardholder pays their bill on time and keeps their balance low, those good habits can be mirrored on your credit report. This strategy is so common that a TransUnion study found that about 19% of teens are authorized users on a parent's card, showing just how mainstream this approach has become.

What Actually Shows Up on Your Credit Report?

When you're added to an account, several key data points from that credit card can be reported to the credit bureaus under your name. This is where the magic happens.

Here’s what typically gets added:

The success of this strategy hinges entirely on the health of the primary cardholder's account. To make sure you're getting a boost and not a burden, it’s critical to choose the right account to be added to. The table below breaks down what you need to look for.

Key Factors for Success as an Authorized User

Ultimately, joining an account that checks all these boxes gives you the best possible chance of building a strong credit profile quickly and effectively.

Finding the Right Person to Add You

Your success with this strategy really comes down to one thing: the financial habits of the person adding you. This isn't just about finding a willing volunteer. You need to find someone with a stellar credit history, because their good habits are what you'll be "borrowing" to build your own.

Think of it like choosing a financial mentor. Their great track record can give your credit file a powerful head start.

Start by thinking about trusted family members or very close friends. The ideal person has a credit card account that is a textbook example of responsible use.

Key Account Traits to Look For

So, what does a "textbook example" look like?

First and foremost, look for someone with a long history of making 100% on-time payments. This is the single biggest piece of the credit score puzzle. The account should also be well-established—we're talking several years old, not a brand new card. That history length is what will help you most.

Beyond that, the most critical number to look at is their credit utilization ratio. This is just a fancy way of saying how much of their available credit they're actually using.

You want someone who keeps their balance low. The gold standard is below 30% of their total limit, but lower is always better. For instance, if they have a 10,000 credit limit, their balance should consistently be under 3,000. This signals to the credit bureaus that they manage their money wisely. You can see a full breakdown of what affects a credit score most in our detailed guide.

Having the Conversation

Asking for this kind of help can feel awkward, but it doesn't have to be. It's all about how you frame it.

Explain why you're working to build credit with your ITIN and how their strong account history can give you a solid foundation. With Americans holding an average of four credit cards each, many people are familiar with the system and might be more open to helping than you think. In fact, adding an authorized user is a pretty common way for people to help family members get started. If you're curious, you can find more global credit card statistics over on Spendesk.com.

Be very direct and tell them you understand they are legally responsible for all charges on the account. That's precisely why you aren't asking for a card or for spending privileges. This simple reassurance can turn a potentially risky financial request into a simple, supportive gesture.

Getting It Done: How to Add an Authorized User

So, you've found someone willing to help you out? Great! The good news is that the actual process of adding you as an authorized user is usually pretty straightforward. Most of the time, the primary cardholder can get it all done in just a few minutes right from their online account or mobile app.

They'll just need to log in, poke around their account settings (look for things like "Account Services" or "Manage Users"), and find the option to add an authorized user. It's a common feature, so it shouldn't be too hard to locate.

The Info You'll Need to Provide

To make things smooth, have your information ready for the cardholder when they're ready to add you. They'll need to plug this into the online form.

You should be prepared to give them:

Some credit card companies might also ask for your ITIN or Social Security number. It’s not always a requirement, but it’s a good idea to have your ITIN handy just in case.

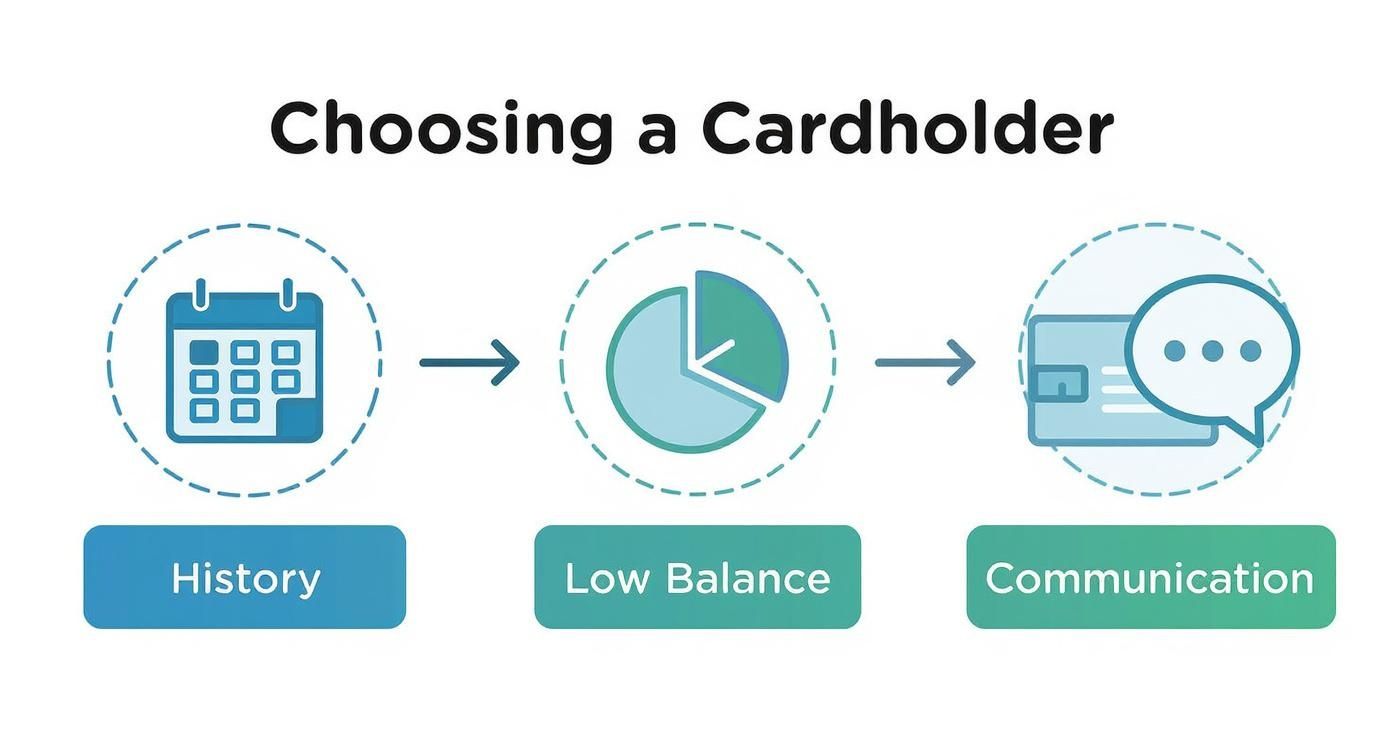

This infographic breaks down the key things to look for in a primary cardholder, from their credit habits to their communication style.

As you can see, you’re looking for someone with a long history of on-time payments, who keeps their balances low, and who is open to talking about the rules of this arrangement.

The Most Important Step: Confirm They Report to Credit Bureaus

Okay, this is the part you absolutely cannot skip. This whole strategy hinges on one thing: the credit card company must report authorized user activity to the three main credit bureaus—Experian, Equifax, and TransUnion. If they don't, this won't help your credit at all.

Big names like Chase, Capital One, and American Express almost always report for authorized users, but you can't assume. Policies can and do change.

Don't move forward until they get a clear and confident "yes." This one phone call is the difference between this being a powerful credit-building tool and a complete waste of time. Once you have that confirmation, you're officially on your way.

So, You've Been Added as an Authorized User... Now What?

Once the primary cardholder submits the request to add you to their account, you might be eager to see your credit score jump. But it's important to know this isn't an overnight process. Think of it more like a waiting game.

The credit card company needs to report this new information to the major credit bureaus. This usually happens according to their own reporting schedule.

So, how long does it take? You can generally expect to see the new account pop up on your credit report within one to two billing cycles. In most cases, that means somewhere between 30 and 60 days. This delay is totally normal, so the key here is patience.

How It Looks on Your Credit File

When that account finally does appear, it can make a huge difference, especially if you're starting from scratch. Let's look at a real-world example. Carlos, an ITIN holder with no credit history, was added as an authorized user to his aunt's credit card. She's had the card for 12 years, always pays on time, and keeps the balance low.

Within two months, that entire 12-year history appeared on his brand-new credit report. This new tradeline (the official term for any account on your report) instantly gave him a solid foundation, positively impacting the most important credit scoring factors:

Time to Double-Check Everything

After waiting about two months, it's time to make sure your plan worked. You need to pull your credit reports from the three big bureaus: Equifax, Experian, and TransUnion. The good news is you can get free weekly reports from all of them.

Once you have your reports, comb through them to find the new account. Make sure it's listed and that all the important details, like the payment history and account age, are showing up correctly. This final check is crucial—it confirms that being an authorized user is actually helping you build the credit profile you need.

To get a better handle on how this all works, take a look at our guide on understanding the role of credit report tradelines in shaping your financial future.

Understanding the Risks for Everyone

Adding an authorized user can be a fantastic way to build credit, but it's not a magic bullet. It's a two-way street, and both you and the primary cardholder need to walk into it with your eyes wide open. A frank conversation about the potential downsides is the most important first step.

What’s at Stake for the Primary Cardholder?

Let's be crystal clear: the primary cardholder is taking on the biggest risk. They are 100% legally on the hook for every single charge made on the account, including any you might make.

If the bill goes unpaid, their credit score is the one that suffers. Late payments, high balances—it all falls on them. This is a huge leap of faith on their part.

Protecting Everyone Involved

So, how do you make this work without putting anyone in a tough spot? The easiest solution is for the cardholder to add you as an authorized user but simply not give you a physical credit card.

Your goal here is to piggyback on their good credit history, not to spend their money. This one simple move completely removes the financial risk for them.

For you, the risk is different. If the primary cardholder starts missing payments or racks up a huge balance, that negative activity can show up on your credit report, too. Instead of building your score, it could end up tanking it. This strategy is only as good as the primary user's financial habits.

In the U.S., where 66.7% of adults have a credit card, being an authorized user is a fairly common practice. You can learn more about global credit card ownership trends on CardRates.com to see how this compares worldwide.

Questions That Come Up When Building ITIN Credit

If you're building credit with an ITIN, you're bound to have questions. It’s a path less traveled than the traditional SSN route, so getting clear answers is everything. Let's tackle some of the most common things people ask.

Will the Credit Card Company Actually Report Me as an Authorized User?

This is the make-or-break question, and the answer is a big "not always."

You'd be surprised how many people miss this step. Most big banks like Chase or Capital One will report authorized user activity to the three main credit bureaus—Equifax, Experian, and TransUnion. But some smaller banks or credit unions might not.

Before anyone adds you to their account, they absolutely must call the number on the back of their card and ask a simple question: "Do you report authorized user activity to all three credit bureaus?" If the answer is no, this strategy won't do a thing for your credit file. It’s a crucial first step.

Do I Get My Own Physical Card?

You can, but you don't actually need one to build your credit score. The primary cardholder can certainly request a card with your name on it.

However, the real goal here is to get their positive payment history and low credit utilization onto your credit report. Many people set this up so the authorized user never even gets a physical card. This completely removes the risk for the person helping you out, since you can't make any purchases.

And remember, the primary cardholder is always in control. They can remove you from the account at any time.

Ready to take control of your credit journey with your ITIN? Sign up with itin score today for free credit monitoring and a personalized plan to build your financial future. Get started now at https://www.itinscore.com.