2nd Chance Banking: Rebuild Your Financial Future Today

Think of 2nd chance banking as a financial do-over. It's a lifeline for anyone who's been turned down for a traditional bank account because of some past stumbles, like bounced checks, unpaid fees, or having an account closed by the bank.

Why 2nd Chance Banking Matters

Ever tried to get by without a bank account? It’s a huge headache. Simple things like cashing a paycheck, paying your rent, or buying something online become a real challenge. You end up relying on expensive check-cashing stores or clunky money orders, and those fees slowly chip away at your money.

That’s the exact gap second-chance banking was created to fill. A surprising number of people are "unbanked" or "underbanked," often because of past financial hiccups. They get stuck in a frustrating cycle, unable to get the basic tools needed for financial stability.

By offering a straightforward way back in, 2nd chance banking gives people a structured path to rejoin the financial system. It’s a massive issue, and you can learn more about the global challenge from the experts at S&P Global Market Intelligence.

Who Benefits From A Fresh Start

These accounts are much more than just a place to keep your cash. They're a tool for rebuilding your financial reputation, specifically designed for people who have a negative mark on their record with reporting agencies like ChexSystems.

A 2nd chance account might be right for you if you’ve had:

In the end, these accounts provide the must-haves for modern life—like a debit card and direct deposit—without the strict approval process of a standard account. They let you get back in control and start building a positive track record. To see what that really means, let's break down the key differences.

2nd Chance Banking vs Standard Banking at a Glance

Getting a handle on the trade-offs is key. This quick table lays out the typical differences you’ll find between a 2nd chance account and a standard one.

As you can see, 2nd chance accounts come with some limitations, like fees and fewer perks. But the goal isn’t to stay there forever—it’s to use it as a stepping stone back to a fully-featured, standard bank account.

How to Know If You Need a Second Chance Account

So, how do you know if 2nd chance banking is the right path for you? It really starts with a look in the mirror—your financial mirror, that is.

Just like credit bureaus keep tabs on your loans and credit cards, a couple of specialized agencies track how you handle your bank accounts. The two heavy hitters you need to know are ChexSystems and Early Warning Services (EWS).

Think of them as the gatekeepers for new bank accounts. When you apply for a simple checking or savings account, most banks and credit unions will pull a report from one of them. This report gives them a detailed history of your past banking habits and flags anything they might see as a risk.

If you’ve been turned down for a standard bank account more than once, that's a huge clue. It's a strong sign that something on your ChexSystems or EWS report is raising a red flag. The good news is, you don't have to stay in the dark.

Checking Your Banking Report

Your first move should be to pull your own consumer disclosure report. Thanks to the Fair Credit Reporting Act, you’re entitled to a free copy from each agency every 12 months. The process is simple and can be started right on their websites.

Getting your hands on this report is the only way to know for sure why banks are saying no. It’s not just a score; it’s a detailed breakdown of your history.

Once you have the report, you need to look for the common culprits that scare banks away.

These are some of the most frequent reasons for a negative mark:

Weighing the Pros and Cons of Second Chance Banking

Jumping into 2nd chance banking is a big move. Like any financial product, these accounts have their own unique set of upsides and downsides. Getting a clear picture of both sides of the coin is the best way to make a smart decision and know exactly what to expect.

Think of a second chance account as your official on-ramp back into the mainstream financial system. It’s designed to break that frustrating loop of being unbanked, where you’re stuck relying on expensive check-cashing stores and money orders just to manage your own money.

The practical benefits kick in almost immediately. For most people, simply being able to set up direct deposit is a huge relief. No more waiting, no more fees—your paycheck just shows up safely where it belongs. You also get a debit card, which is pretty much essential for everything from buying groceries to paying bills online.

The Clear Advantages of a Fresh Start

The single biggest plus? This is your chance to rebuild your banking history from the ground up. Every month you handle your account well—by keeping a positive balance and steering clear of overdrafts—you’re actively proving you can be a reliable customer.

Here’s a quick rundown of the major upsides:

Understanding the Potential Downsides

While the benefits are compelling, it’s just as important to go in with your eyes open about the trade-offs. Because these accounts are built for people who are seen as higher-risk, they almost always come with more guardrails and fees than a typical account.

These limitations are really there to protect the bank while you get a chance to demonstrate you’re back on track.

Here are the most common drawbacks you'll encounter:

It's helpful to see these "cons" not as punishments, but as part of a simplified system designed to help you focus on building good financial habits. By carefully weighing these pros and cons, you can figure out if 2nd chance banking is the right strategic move for your financial comeback story.

Comparing The Best 2nd Chance Banking Options

Alright, you've decided a second-chance bank account is the right move. That’s a huge step forward. Now comes the part where the rubber meets the road: choosing the right one.

Don't just jump at the first offer you see. Not all these accounts are built the same, and the right choice can seriously speed up your journey back to financial health. It’s time to look past the flashy marketing and get into the nitty-gritty details that really matter. You'll find these accounts offered by everyone from the big national banks to your local credit union, so you've got options. Your mission is to find the one that fits your life and gives you a clear, realistic path to a standard account.

Key Factors To Compare

When you start weighing your options, think bigger than just one feature. A super-low monthly fee looks great on paper, but if that account comes with frustratingly low spending limits or a clunky mobile app, it’s going to cause more problems than it solves.

Here’s what you should be zeroing in on:

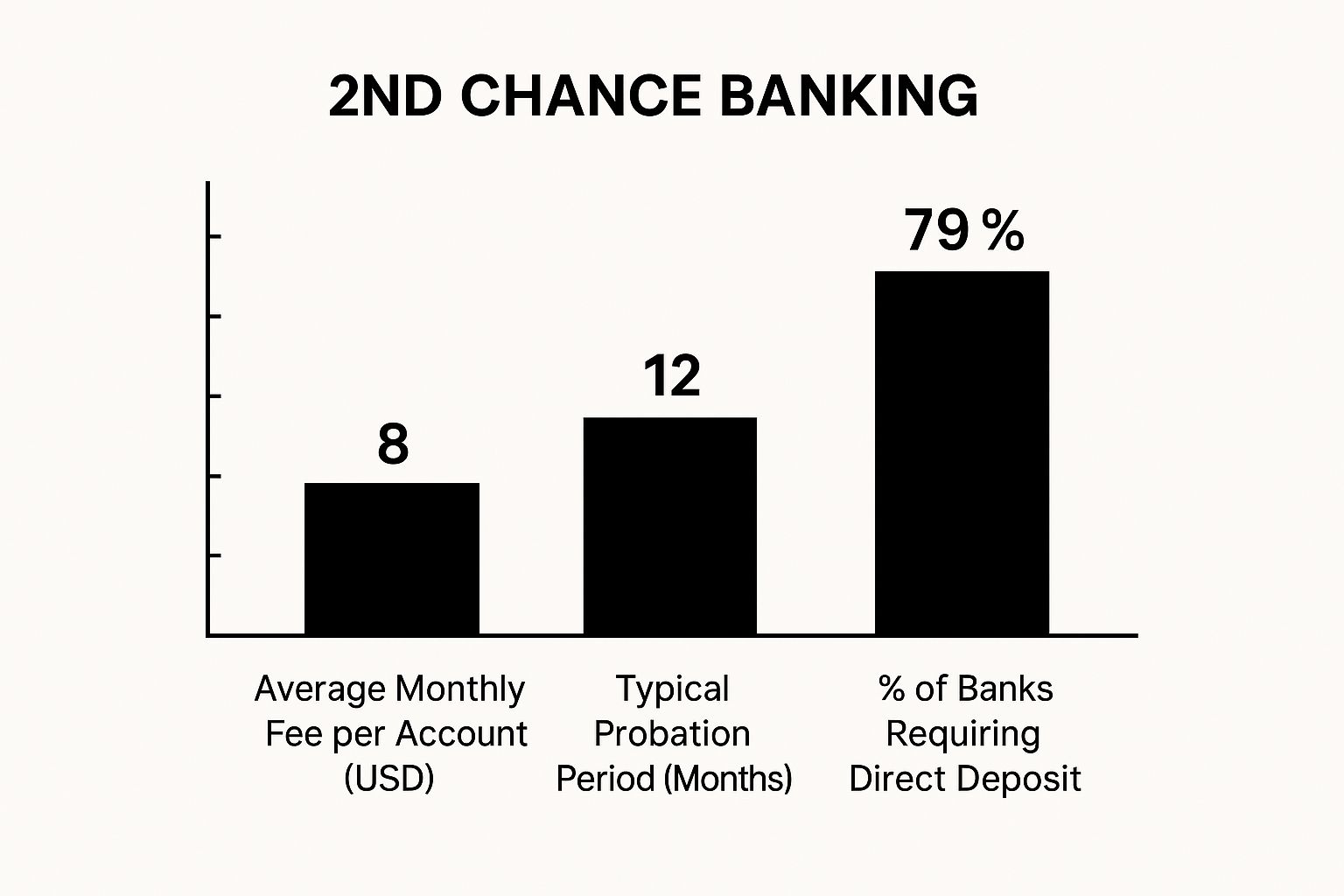

This chart gives you a bird's-eye view of what's typical in the industry, so you know what to expect.

As you can see, while monthly fees are common, the timeframes and requirements for getting back into a standard account can be all over the map.

A Look At Top Contenders

While your local options are always worth a look, several nationwide players have built a solid reputation for offering accessible accounts. They've figured out how to design products that genuinely help people rebuild their banking track record.

In the U.S., second-chance banking has become a lifeline for people who've been locked out of the system. The banks see the value, too—they often report that 50% or more of these customers successfully move up to standard accounts within 12 to 18 months. Technology is making it easier for banks to offer these products effectively, a trend you can read more about in this analysis of global banking trends on Finovate.com.

To make things easier, I've put together a table breaking down a few popular options. This side-by-side view helps you see the trade-offs at a glance.

Feature Comparison of Top 2nd Chance Bank Accounts

A side-by-side comparison of leading second chance checking accounts to help you choose the best option based on fees, features, and graduation requirements.

Ultimately, picking the right second-chance banking partner is a personal choice. By taking the time to compare these key features, you can find an account that doesn't just work for you today but also helps you build a much stronger financial future.

Your Step-by-Step Guide to a Successful Application

Opening any bank account can feel like a chore, and it's easy to feel a little intimidated when you're looking at second-chance banking. But don't worry, the process is usually much simpler than you think. Let's walk through it step-by-step.

Get Your Documents in Order First

Before you even think about filling out an application, the best thing you can do is get all your paperwork together. Having everything ready ahead of time turns a potential headache into a smooth, quick process.

You'll almost certainly need these three things:

Fill Out and Submit the Application

Once your documents are in a neat pile, you're ready to go. Most banks let you apply online in just a few minutes, which is incredibly convenient. If you'd rather talk to someone face-to-face, you can always stop by a local branch.

A quick heads-up: the application might ask about your past banking problems. Just be honest. These accounts were created specifically for people who've had financial bumps in the road, so being upfront is the right move.

Finally, you’ll need to make an initial deposit. The good news is that it's often a small amount, sometimes $25 or less. Just have the funds ready to go. As soon as you fund the account, you’ve officially taken the first big step toward rebuilding your banking history.

Think of your second-chance banking account as a financial training ground. It’s an incredibly useful tool, but it's not meant to be a permanent solution. The real win is using it as a stepping stone to graduate to a standard bank account that comes with better features and fewer restrictions. This is your game plan for getting there.

The whole process boils down to one simple concept: proving you're a responsible customer. Banks are looking for a consistent, positive track record. It's all about building solid financial habits that show you can manage your money without hitting the same old snags.

A great first step is to treat your account like a pro. Set up direct deposit for your paycheck so the bank sees a steady, reliable flow of income. That one move sends a powerful signal that your finances are on solid ground.

Building a Positive Banking History

On this journey, consistency is everything. Banks generally want to see 12 to 18 months of squeaky-clean account management before they’ll even consider you for an upgrade. Your mission during this time is to consciously avoid the mistakes that might have landed you in this position in the first place.

Here are the core habits you need to lock down:

Mastering the basics is key. For instance, getting good at these essential bank reconciliation tips is a fundamental skill for keeping your finances in order.