Credit Visibility for the Invisible.

The first and only credit platform built specifically for ITIN holders. Check your credit score, get personalized advice, and build your financial future, all without an SSN.

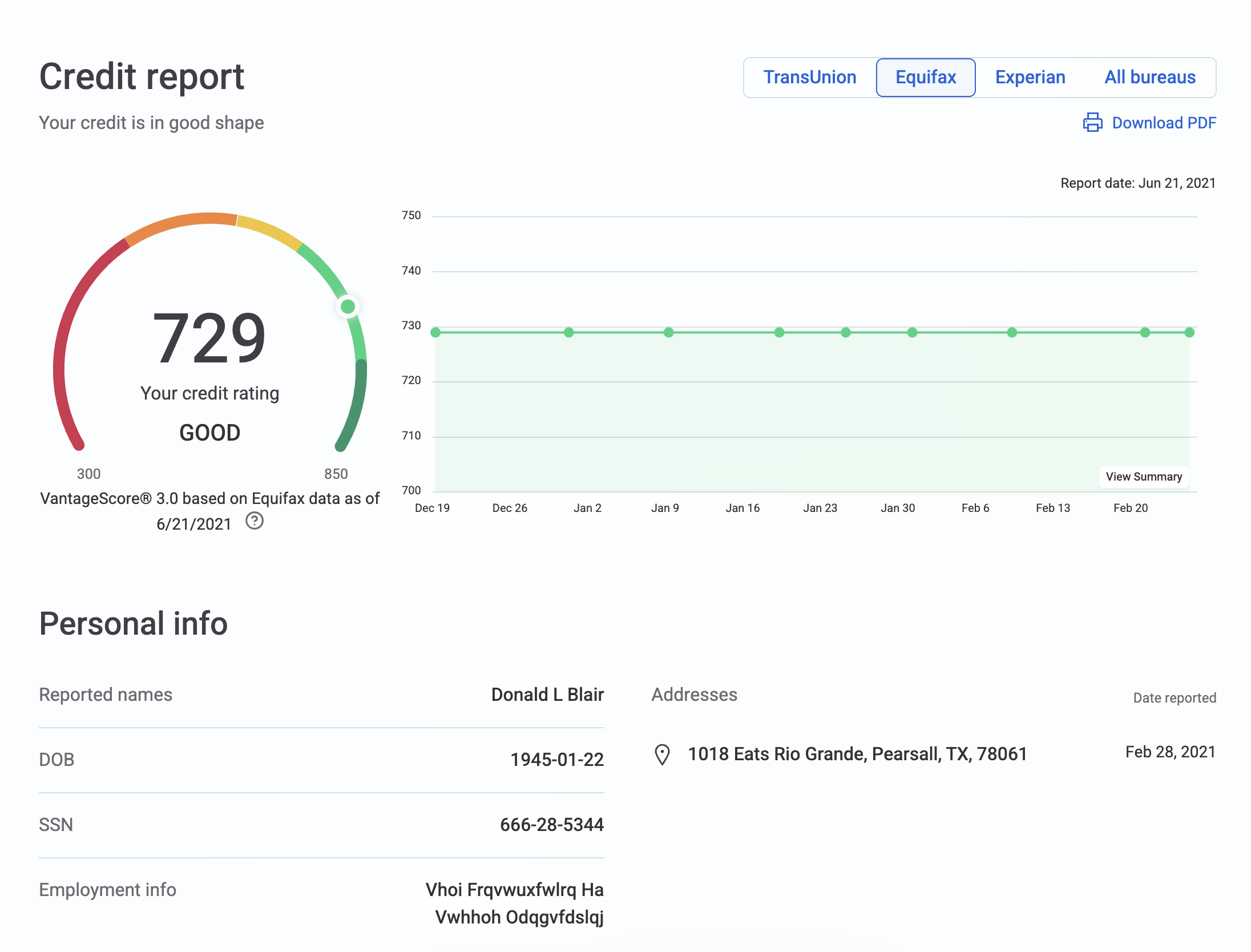

Complete Credit Report

Access your full credit report from all three bureaus with detailed breakdowns of your credit score, personal information, and credit history.

Ready to see your real credit report?

Get instant access to your complete credit profile, personalized insights, and tools to improve your score.

More Powerful Features

Comprehensive tools and support designed specifically for ITIN holders

ITIN Credit Score Monitoring

Check your credit score using only your ITIN. Get detailed reports and track your progress over time.

Detailed Credit Reports

Access comprehensive credit reports with explanations in multiple languages. Understand what affects your score.

Real-Time Monitoring

Get instant alerts when changes occur to your credit report or when new accounts are opened

How It Works

Getting started with ITIN Score is simple and secure. Follow these three easy steps to begin building your credit.

Enter Your ITIN

Securely provide your ITIN number and basic information. We use bank-level encryption to protect your data.

Verify Your Identity

Complete a quick identity verification process. This helps us pull your credit report safely and securely.

Get Your Score

View your credit score and detailed report instantly. Start receiving personalized recommendations to improve your credit.

Trusted by ITIN Holders Nationwide

Join thousands of ITIN holders who have taken control of their credit journey with ITIN Score.

What ITIN Holders Are Saying

Real stories from people who've improved their credit with ITIN Score.

Finally, a credit service that understands ITIN holders! I was able to see my credit score for the first time in years and get personalized advice.

Has been difficult to see my credit score with no SSN, but with this platform I can track all related to my credit and I can start to build the future I'm looking for.

Improved my credit score by 120 points in 8 months using their recommendations. Now I qualify for better loans and credit cards!

Frequently Asked Questions

Everything you need to know about ITIN Score and credit monitoring for ITIN holders.

Can I really check my credit score with just an ITIN?

Yes! If you have an ITIN and have established credit history in the US, you can access your credit score and report. Many ITIN holders don't realize they already have a credit file with the major bureaus.

Will checking my credit score hurt my credit?

No, checking your credit score through ITIN Score is a "soft inquiry" that doesn't impact your credit score. You can check as often as you want without any negative effects.

How is this different from other credit monitoring services?

ITIN Score is specifically designed for ITIN holders. Most credit services require an SSN, but we've built our platform to work with ITINs. We also provide educational content and product recommendations tailored to the ITIN holder community.

Is my personal information safe?

Absolutely. We use bank-level security including 256-bit SSL encryption, secure data centers, and strict privacy policies. We never sell your data and are fully compliant with all federal regulations.

Ready to Take Control of Your Credit?

Join thousands of ITIN holders who have already started their credit journey with ITIN Score. Get your credit score in just 2 minutes.

no hard pull • Cancel anytime • Bank-level security

About ITIN Score

We're on a mission to provide equal access to credit monitoring and financial tools for all ITIN holders.

Our Mission

To bridge the credit gap for ITIN holders by providing the same access to credit monitoring and financial tools that SSN holders have always had.

Why We Exist

ITIN holders in the US have been underserved by traditional credit monitoring services. We're changing that with purpose-built tools and guidance.

Our Values

Transparency, security, and accessibility guide everything we do. We believe everyone deserves access to their credit information and the tools to improve it.